Whenever consider up whether to switch to a fixed rate mortgage, there clearly was so much more to consider than the speed. ( ABC Development: Jessica Hinchliffe )

Rates reaches checklist lows. Although that’s bad news to suit your checking account, it’s very good news when you yourself have a mortgage.

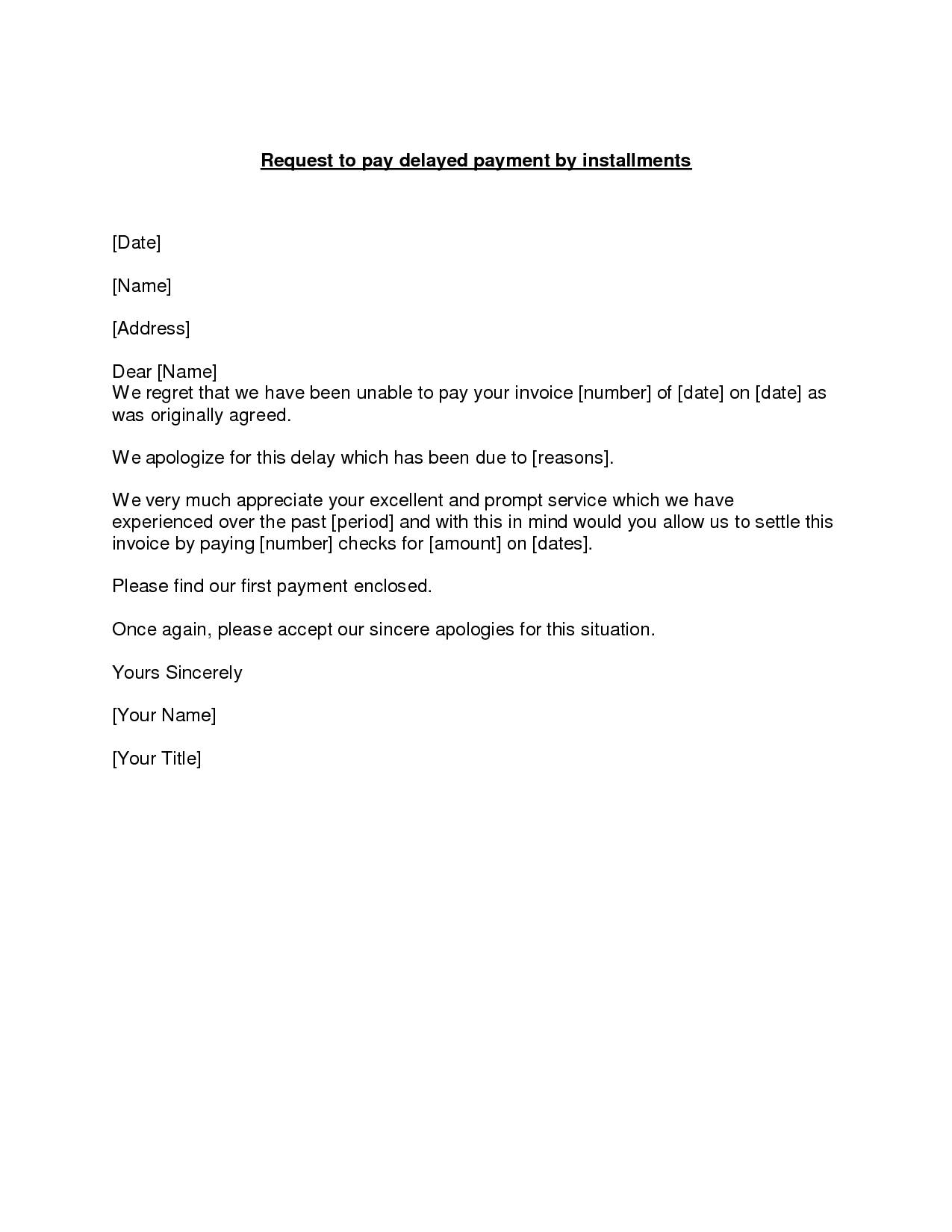

That question you may be questioning is whether or not so you’re able to lock in your instalments because of the switching to a fixed price financial.

Fixed rates financing could help when you are with limited funds

- You realize exactly how much your payments is across the fixed-period;

- If the interest rates raise inside the fixed months, the mortgage rate wouldn’t boost.

He states the new predictability off fixed speed mortgages are going to be like helpful for basic-home buyers and folks toward rigid finances.

“Understanding that the fortnightly or monthly money is a comparable produces budgeting smoother,” according to him.

For many who alter your head, you will need to shell out a rest percentage

If you want to replace away from a fixed rates mortgage, you’ll likely have to pay a rest fee. And will be significant.

Depending on the loan dimensions, interest rate actions and your financing title, these charges can easily arrived at several thousand dollars.

“If there’s a sign that you may possibly think moving property otherwise if you want to alter funds, ensure that it it is adjustable as you should not spend you to definitely commission if you don’t seriously have to,” says Adrian Willenberg, a large financial company based in Melbourne.

Fixed price money will often have constraints into most money

Generally speaking, finance permits some more money for each and every seasons or over the word of one’s mortgage. Immediately following one restriction are surpassed, subsequent repayments attention costs.

While concerned about the brand new payment constraints, but still want much more certainty over your instalments, one to option is to break the loan.

“Let’s say someone is actually borrowing from the bank $five-hundred,000. They may always set $350,000 from inside the a predetermined rate loan, and then leave $150,000 adjustable,” Mr Willenberg states.

In the event the interest rates slip, you might become purchasing alot more

The top chance that have repairing their speed is the fact rates is also always shed, causing you to be investing a lot more in the appeal than simply you if you don’t create.

Mr Georgiou says interest levels are nearly impractical to expect, so it is best to decide according to individual economic situations.

“The idea I might make would be the fact people choice to resolve the rates will likely be since the you reviewed your budget, the affordability, and also you require you to confidence,” he states.

“The option are going to be predicated on that rather than a go to attempt to outsmart a complete field of very smart dealers, who generally have huge amounts of bucks invested.”

Repaired price fund normally have limited features

If you love to make use of your own offset membership otherwise redraw facility, recall these characteristics is actually less common that have repaired loans.

They generally might be designed for a supplementary payment, the place you case you really need to think about brand new pros instead of the costs.

Refinancing and you may mortgage brokers

If you are looking to re-finance your house mortgage, should you explore a mortgage broker? I go through the benefits and drawbacks in order to make a knowledgeable choice.

One which just option, have a look at a range of lenders

- Shop around supplied by lenders;

- Discover other sites you to aggregate financial situations, and so they can be useful. Remember these sites can get collect important computer data – in addition they will most likely not identify all your options;

- Explore home financing calculator observe how changing will apply to their payments.

Some people choose to fool around with a large financial company to enable them to contrast and implement for affairs, you could also do it yourself.

Should you choose decide to use a brokerage, will still be beneficial to become equipped with some knowledge about the situations you happen to be shopping for.

When you find yourself not able to make your home mortgage repayments, you can find available options

Economic counsellors for example Mr Georgiou are unable to assist you in deciding whether or not to boost your house mortgage, nevertheless they makes it possible to rating a clearer picture of their finances and your budget.

Monetaray hardship page info:

- Federal Financial obligation Helpline: 1800 007 007

- Mob Good Financial obligation Help: 1800 808 488

- ASIC’s Moneysmart web site

- Australian Monetary Grievances Authority