In this post

- Exactly what data files do you wish to score a home loan preapproval in Georgia?

- step 1. Evidence of Money and you will A job

- dos. Details off Possessions

- 3. List of Monthly Financial obligation Payments

- 4. Information out of Most other Costs and you can Financial Incidents

You made the choice to purchase a home into the Fl and you have read you to getting financial support pre-acceptance is the greatest matter you want to do before you even begin family hunting. It is actually high advice about one or two key grounds.

Very first, you should understand the particular price range within your arrived at and so helping you save a lot of anger and date. And you will next, if you get pre-recognized, providers are more inclined to take you surely for example feel so much more happy to get into genuine negotiations.

Exactly what data would you like to score a home loan preapproval within the Georgia?

Before you head out to the bank, just be sure to have specific documents to own a home loan pre-recognition within the Florida.

step 1. Evidence of Earnings and you can Work

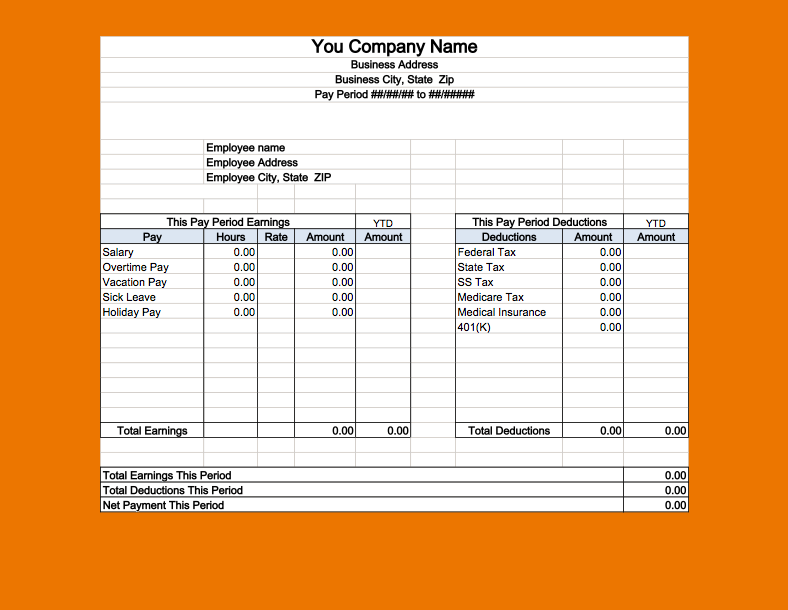

You are going to without a doubt need inform you loan providers that you’re not simply functioning and that your earnings will do adequate for that keep up with the home loan repayments per month.

The type of documents necessary for mortgage pre-recognition for the Fl rely on your a career situation as well as the way you try paid back. Nevertheless, in every instance, you’ll likely be asked to offer duplicates of your earlier 2 years’ tax productivity, one another state and federal.

- Salary Earners plus the Salaried: Copies of the past few shell out stubs and most present dos years’ W-dos versions plus information of incentives and you will overtime.

- Self-Employed Individuals (Freelancers and Independent Designers): Profit-and-loss comments while the last couple of years’ Means 1099. This also boasts S-organizations, partnerships, and you will sole proprietorships.

For those who have one, additionally, you will be asked to offer evidence of real estate money. When it is accommodations possessions, you’re required to supply the property’s market price collectively having proof of local rental earnings.

dos. Information from Possessions

A listing of possessions is yet another of data files you are going to be required to enable financial pre-approval into the Florida. For every savings account (discounts, examining, money markets, etcetera.) you will want duplicates with a minimum of 60 days’ property value statements.

Furthermore, you want the new comments over the past 8 weeks for all your financial support membership instance Dvds, stocks and you will bonds. Its also wise to expect you’ll deliver the most up to date quarterly declaration exhibiting the vested balance when it comes to 401(k)s.

3. Set of Month-to-month Loans Costs

Lenders will really wish to know exactly how much you pay out per month to fund your debts. So, you might be necessary to offer authoritative ideas out of month-to-month loans-fee obligations instance student loans, almost every other mortgage loans, auto loans, and you may playing cards. Lenders will demand you to definitely give per creditor’s term and address, and the account balance, minimum commission, and you may mortgage equilibrium.

If you are already leasing, you will likely be asked to provide rent-payment invoices over the past 12 months. Be sure becoming willing to offer property owner contact info to possess perhaps the earlier 2 yrs.

4. Information regarding Almost every other Expenses and Economic Events

Other facts that will be area of the data needed for home loan pre-acceptance inside Florida are those utilized for recording specific lifetime-experience expenses. Including, when you’re separated, just be ready to bring courtroom purchases for youngster help and you may alimony money. If you have Riverside savings and installment loan announced bankruptcy proceeding otherwise experienced foreclosure, you happen to be necessary to give related files.

Let me reveal one to final believe. Lenders can sometimes concern your how you plan to fund this new advance payment into assets. Very, keep in mind that you are required to reveal proof of the fresh new resources of currency for the purpose.

Are pre-accepted to have money would depend mostly to your records you bring and when you have done that, you might carry on your home-search journey.

When you need to find out more about the best a way to rating pre-recognized with other financial support possibilities, get in touch with because of the cellular phone in the otherwise from the filling out the quick quotation!