You made it because of Chapter 7 bankruptcy. Congratulations! You released the debt and get as clean a record because you can aquire. Now, you want to go on with your brand new economic life occasionally pick a house. But how can you qualify for an interest rate just after Chapter eight bankruptcy?

Despite just what we imagine, your ideal of becoming a citizen need not perish when you go thanks to Chapter 7 case of bankruptcy. Bankruptcy proceeding is a perfectly court and appropriate answer to discharge costs, this cannot prevent you from being qualified for home financing loan.

not, your A bankruptcy proceeding case of bankruptcy situation could affect otherwise reduce your eligibility getting a mortgage loan. To find out more, continue reading and you can run the experienced personal bankruptcy lawyers in the Cleveland Bankruptcy Lawyer. We are able to ensure that your case of bankruptcy happens effortlessly, so you are in an informed updates shortly after your own release. 100 % free consults appear from the Cleveland Bankruptcy proceeding Lawyer: (216) 586-6600.

Rebuilding The Borrowing from the bank

If you’d like to get a mortgage after declaring bankruptcy proceeding, perhaps one of the most important matters you can certainly do was grab real strategies to help you reconstruct the borrowing. Personal bankruptcy in addition to occurrences that frequently lead up so you can it can hurt your credit rating. Now that you are on one other edge of bankruptcy, you must generate you to definitely score backup.

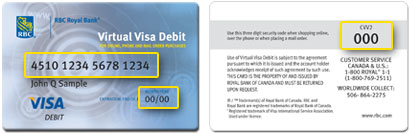

Among fastest ways so you can rebuild your borrowing from the bank immediately after Chapter seven is to find the fresh new credit lines and outlay cash off completely each month. You are able to get an extra bank card, a secured card you to definitely attributes such as for example a good debit credit but will get said into the credit agencies, or a personal bank loan.

Expenses any of these personal lines of credit from on time suggests your accountable for your debts, that will raise your score. Additionally the higher your credit score is actually, the much more likely its that you will get good conditions for your home mortgage or even get the mortgage whatsoever. Keep in mind that do not rating lines of credit that you won’t have the ability to pay off; this can after that spoil their borrowing.

Post-Personal bankruptcy Mortgage loans

Each kind out of mortgage loan that you can get shortly after Chapter seven case of bankruptcy will receive different requirements. Below, i glance at the popular sort of mortgages and ideas on how to meet the requirements once A bankruptcy proceeding bankruptcy proceeding.

FHA Finance

Brand new Government Casing Management guarantees FHA mortgages. The Chapter 7 bankruptcy have to have come released about one or two decades previous for you to meet the requirements.

Va Money

This new Agency away from Experienced Issues also provides these types of loans so you’re able to You Armed forces veterans. You should hold off 24 months immediately after Chapter 7 case of bankruptcy to utilize and you can meet one of many pursuing the more qualifications:

- Your offered no less than 181 months during the peacetime

- You supported at the very least 90 days while in the wartime

- Your served for around six age throughout the National Guard

USDA Financing

The usa Department regarding Agriculture has the benefit of USDA mortgages in order to the individuals looking to buy property for the a rural town. You would not qualify for loans Hackneyville this home mortgage until three years shortly after the A bankruptcy proceeding case of bankruptcy could have been discharged.

Conventional Finance

In place of the other mortgages described, a traditional home loan isnt backed by a federal government agencies. The latest standard prepared months having a timeless mortgage loan once a A bankruptcy proceeding bankruptcy proceeding discharge is few years. not, of numerous non-bodies lenders has actually their wishing period requirements.

Court Assist Shortly after A bankruptcy proceeding Personal bankruptcy

The initial details of their situation will establish which type of post-bankruptcy home loan is right for you. Although it is achievable to help you qualify for a mortgage just after A bankruptcy proceeding bankruptcy, you will likely face particular extreme roadblocks as you pursue this fantasy. This is where a talented Kansas bankruptcy lawyer out-of Cleveland Bankruptcy proceeding Lawyer will come in.