If your down payment is less than 20% of the home’s value, you will need to pay private mortgage insurance (PMI). The annual cost of PMI is around 0.22% so you’re able to dos.25% of home loan.

For example, when you have an effective $300k domestic and place off a great 10% down payment, the loan amount might be $270k. Your PMI could consist of $594 so you’re able to $six,075 a year. PMI are put into your own month-to-month home loan repayments, so that you perform shell out a charge away from $ so you’re able to $506 on top of the standard financing.

The sooner you reach the fresh new 20% control endurance in your family, the earlier their financial is also terminate the brand new PMI and reduce your monthly obligations.

Origination Costs

This might be one other reason to look doing and you can talk with more https://availableloan.net/loans/no-income-loans/ lenders. A financial you are going to promote an effective mortgage terms but have excessive fees that drive enhance complete will cost you.

Property Fees and you can Homeowners insurance

Their month-to-month homeloan payment isn’t their merely statement. Particular loan providers commonly create month-to-month tax and you can homeowners insurance repayments into the mortgage.

That it inhibits you against researching amaze bills after you individual the fresh new home. In case the lender covers this type of costs for your, anticipate your own month-to-month home loan repayments is higher than if you repaid them on your own.

Comparing Financing Terms and conditions: 30-12 months compared to. 15-Season

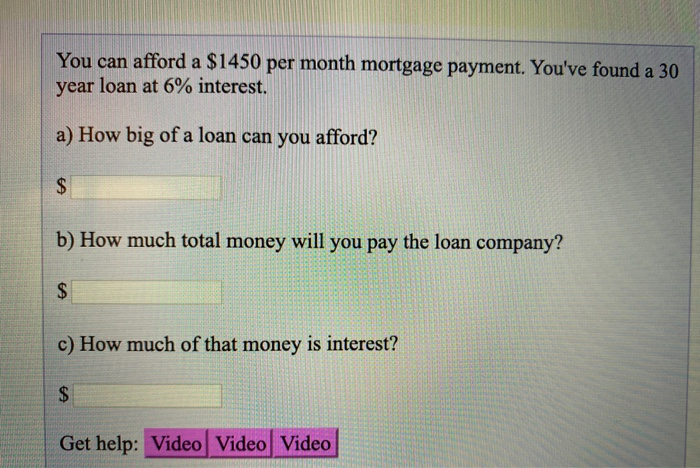

The mortgage term is one of the biggest parts of a beneficial mortgage payment which you have on your own control. If you need a smaller monthly bill, choose a thirty-year home loan. Using this alternative, you will pay-off your debt more three decades.

A good fifteen-12 months financial is reduced. You could pay off your mortgage a great deal more aggressively and you may individual an excellent huge portion of your home faster, however, can get a higher bill every month.

The loan terms and conditions also affect rates of interest. Loan providers normally have straight down notice proposes to people who need fifteen-season financing. If you’re your home loan is highest that have a beneficial fifteen-12 months financing identity, it isn’t as easy as doubling this new requested payment per month. Their percentage may only feel a tiny big due to what it will save you with the focus.

Its worthy of asking your lenders both for fifteen-seasons and 31-12 months proposals observe what kind of differences they make during the the monthly premiums.

Wisdom Home loan Types

Their payment per month computation differ with respect to the style of financial you’ve got. Different mortgage alternatives have various risks and you will ventures. Listed below are some choices to consider as you begin their mortgage look.

- Traditional loan: this is certainly an elementary mortgage provided by a personal financial or bank. Its a fundamental selection for people who need a normal month-to-month homeloan payment and just have good credit.

- Government-recognized mortgage: this is exactly provided by apps built to service particular buyers, eg earliest-day people, pros, and individuals to purchase when you look at the rural elements. This type of loans are better if you have a tiny deposit and the common credit score.

- Jumbo mortgage: it is a giant financing having people that are searching in high-cost-of-living elements eg San francisco bay area otherwise Seattle.

- Bridge mortgage: this might be made use of when purchasing one household if you are attempting to sell a different. The loan usually just continues around 6 months which will be customized to link an economic pit.

Extremely customers explore old-fashioned or regulators-supported mortgage loans. Confer with your financial if you were to think you may need different mortgage options to complement unique circumstances.

Fixed-Price compared to. Adjustable-Price Mortgage loans (ARM)

Once you make an application for a conventional financing, you might determine if or not need a fixed-rate home loan otherwise an adjustable-rates solution. A predetermined-price mortgage comes with the same monthly mortgage payment from the beginning of the mortgage to the end. Your own bank you’ll to alter your payments predicated on their taxation and you will insurance policies, however, there won’t be any adjustments predicated on rates.