Trick Takeaways

- An effective HELOAN is an individual lump sum payment loan reduced more than day

- A good HELOC really works eg credit cards where you only fees what you want

- There are 2 solutions to availableness their guarantee, by using away property equity financing (HEL), otherwise as a result of a property security credit line (HELOC) .

- You to definitely benefit of a good HELOC is that the initially interest are below compared to a property guarantee mortgage.

- Not totally all fund are made equivalent. It is advisable to inquire about your bank issues also to evaluate loan terms.

Property Equity Loan (HELOAN) might be a flat in the of money which you sign up for at one-point after a while & you will pay principle and you may desire to your that money. You are not gonna get access to the funds more and you can over again as you can that have a property Equity Type of Borrowing from the bank (HELOC). A credit line is even going to save a little money because many people have no idea just how much they you want as well as how far they wish to need. Which have a beneficial HELOC you could potentially remove what need a tiny simultaneously & only pay attention on that number. That can help you save tons of money on a lot of time manage. You will get doing 10 years to view you to range out-of borrowing over and over again. This provides you the felxibility to help you with ease availableness financing when the newest monetary means happen.

Researching the two Particular Security Loans

Whether you’re delivering a family member to school, you may like to make some home improvements or combine financial obligation, otherwise surprise costs has arrived upwards, you can access your home’s guarantee if you take aside another home loan. Perhaps the property value your home has increased, you’ve been while making money in your real estate loan for a while, or a combination of one another – regardless, you created valuable security of your home.

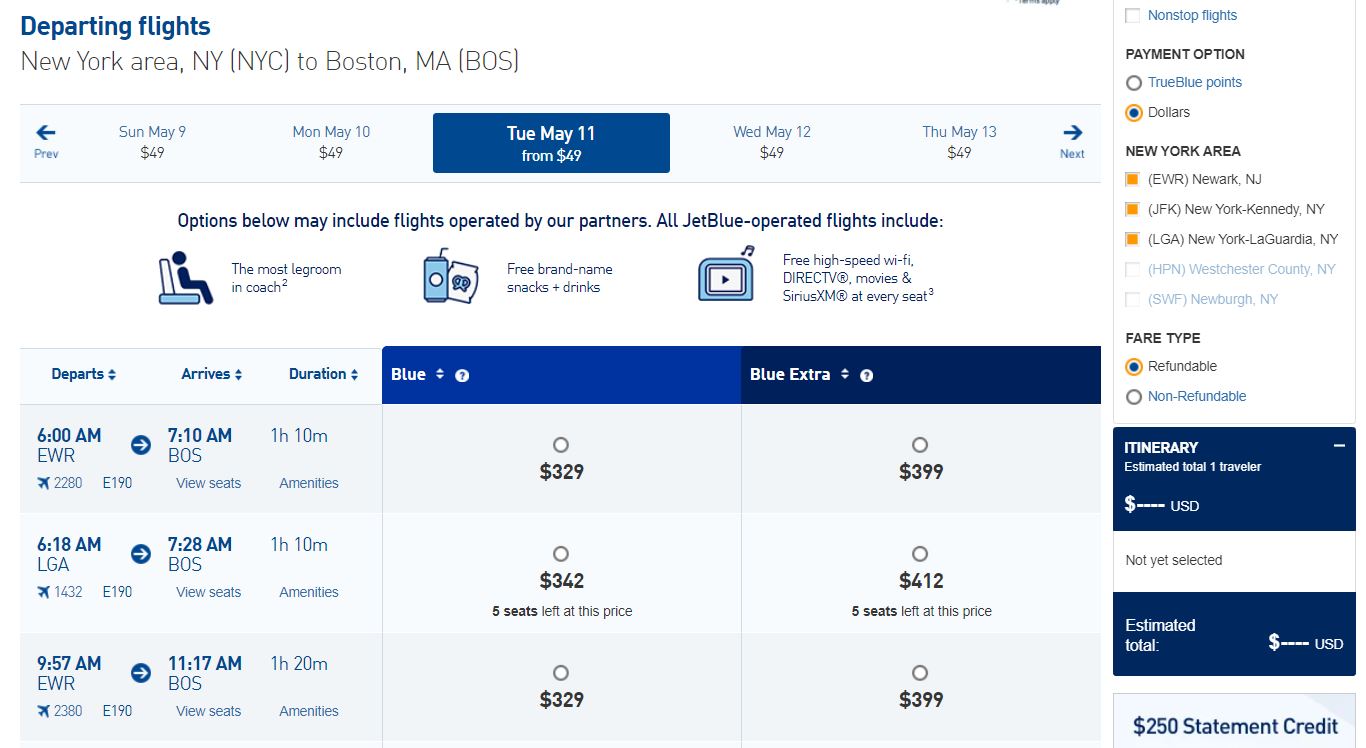

There are 2 solutions to accessibility the equity, by taking away a home guarantee loan (HEL), or by way of a home guarantee personal line of credit (HELOC). Speaking of known as next mortgages and are not to ever become confused with a profit-out refinance loan. The difference may seem subdued, but when you are told and contrast domestic guarantee lending options, you’ll be able to decide which financing is the correct one for the condition.

Dictate your collateral from the subtracting the balance you borrowed from in your financial regarding the fair market price in your home and possessions. Loan providers uses a loan-to-really worth ratio (LVR), the amount your already owe on the family while the amount we should use, than the its well worth, to decide whether they have a tendency to grant you another mortgage.

Please be aware that simply such as your first-mortgage, youre getting your property right up because equity to possess one minute mortgage. The benefit of a second home loan, in comparison with other kinds of funds, ‘s the seemingly straight down interest.

What type of family collateral loan is perfect for your?

The initial concern you will want to ponder before making a decision brand new between your 2nd home loan possibilities was, Carry out Now i need a lump sum payment right now to pay-off a primary bills, otherwise ought i supply dollars from time to time? The following question for you is, Would We propose to shell out that it financing regarding easily, or do I propose to create repayments for a long time?

What exactly is a home Guarantee Line of credit (HELOC)?

An effective HELOC are a credit line, just like that which you receive from a credit card organization. Your acquire extent you prefer when you need it, and you spend notice merely into the number you borrow. Generally speaking, HELOC money enjoys a variable pop over to these guys rate of interest that’s susceptible to increase or disappear. This type of costs try related to the latest show off a particular directory, and additionally a great margin, which is outlined on your HELOC mortgage data files. This is why your monthly minimal financing commission you will definitely improve otherwise disappear over time.