When the saving cash will be your concern, you ought to ask your lender if there is any way your can lower your mortgage payments, Dutton told you. For instance, some settlement costs with loan providers is actually negotiable, including lawyer fees and you can payment pricing. Specific lenders s for very first-go out homebuyers that may help you save several thousand dollars.

Dutton claims this matter will also help your glance at their lender; are they selecting saving you money in new a lot of time work with? Otherwise will they be determined you make payment on full count? When it is the former, Dutton claims you to definitely here is the types of financial you need to work at not only because the you’ll save money, but because ways a sophisticated regarding customer service, that can come in handy regarding the financial process.

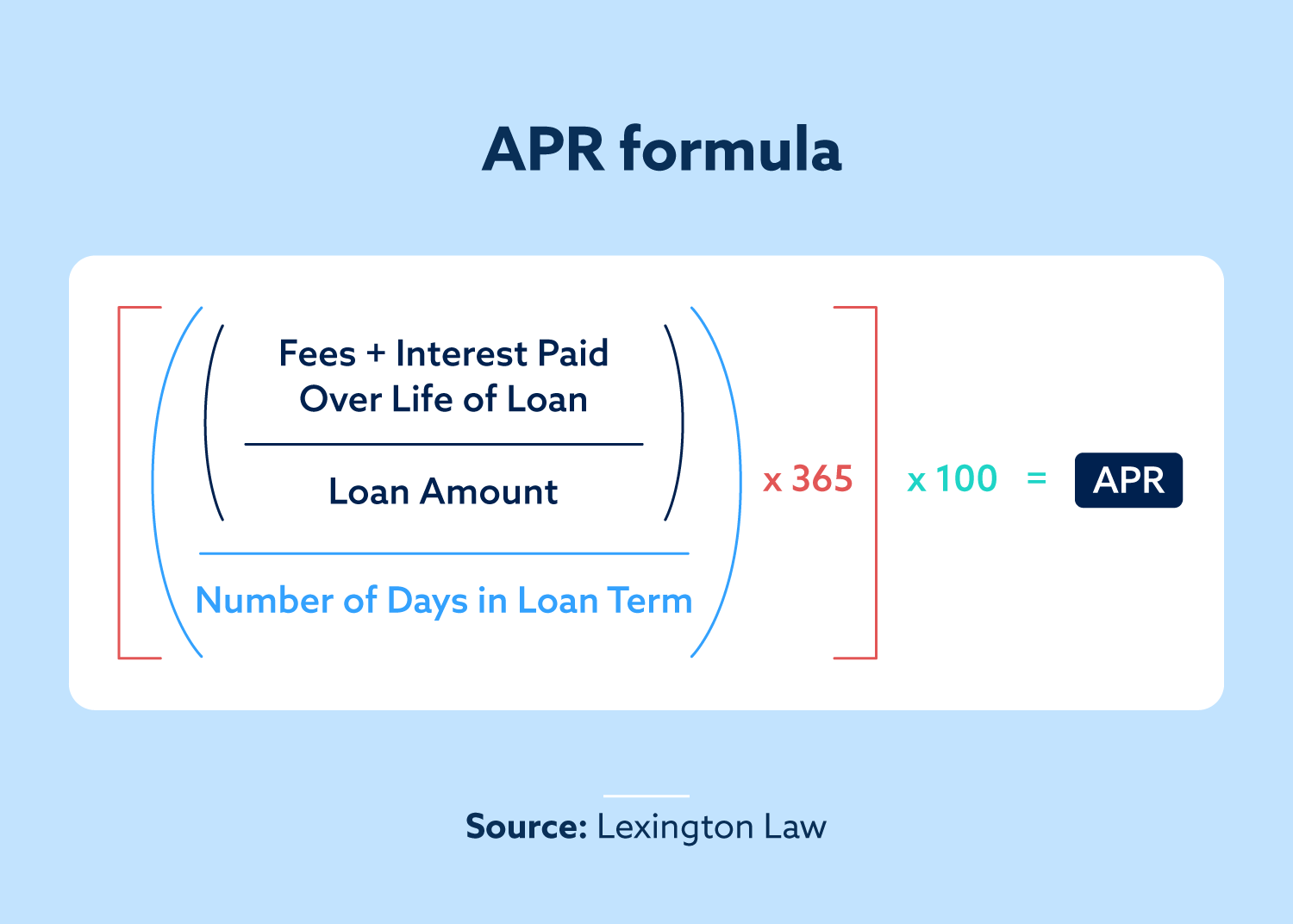

Probably the most essential conditions and terms understand is the huge difference amongst the loan’s interest rate and its particular annual percentage rate (APR), that has both their rate of interest as well as costs the financial institution will costs so you can procedure the loan, Dutton says.

She continues to spell it out one mortgage lenders have a tendency to present a low interest rate to obtain homeowners interested in the newest financing. However, a great loan’s Annual percentage rate try a much more real treatment for understand exactly how much might owe because it is sold with people large financial company charges, rate of interest, discount situations, or other expenses associated with actually obtaining loan. Thanks to this, its higher than the pace by yourself.

As the Annual percentage rate is actually a very over image of just what it is possible to be buying the loan, you’ll want to definitely develop within the with this amount, as opposed to the interest by yourself. So, when comparing lenders, you will need to compare APRs, Dutton told you.

6. Will there be a good Prepayment Punishment about this Financing?

Although you may want to pay back your own financial before plan to save towards the interest, certain loan providers in reality need you to shell out a charge regarding particular good prepayment penalty. hard money personal loans Maryland It’s always best if you show if or not this is actually the instance with their lender before applying into the mortgage very you’re not harm to your backend. In addition to find out about brand new lender’s refinancing strategy to see just what your will have to do subsequently to change your financing entirely.

7. Could there be an interest rate Lock, and you can Carry out I must Pay Significantly more because of it?

An interest rate lock (labeled as a great lock-from inside the otherwise price lock) means the pace your applied for continues to be the exact same up until closing, provided it is over inside an agreed-on time frame. These locks are are not designed for 30, 45, or two months, however might possibly negotiate anything offered. Nevertheless they require you to absolutely nothing alter for the software contained in this that date, or even new secure might possibly be voided and you’ll have to reapply to the financing. Versus an effective secure, the pace you’re originally trying to find could possibly get change by the enough time you are accepted and you can sign-off toward a home loan.

Rates of interest fluctuate each and every day, therefore it is important to lock the interest the moment you’ve got completely done a credit card applicatoin and possess a completely done conversion deal, Treadwell advised.

8. Can i You need Private Financial Insurance rates (PMI)?

Individual Financial Insurance rates (PMI) may be required because of the a loan provider if you do not features a reliable money otherwise a leading enough credit history, and for most other factors that denote a borrower given that an excellent riskier capital. Which insurance rates will definitely cost the new borrower more and will make sure the lending company is actually paid for the currency remaining on a defaulted mortgage. Inquiring in case your lender requires you have a PMI initial allows you to discover of every additional costs you will feel taking up in addition to the mortgage’s monthly obligations.