In the event the job is finished the home might be refinanced which have an extended term home loan from the a reduced interest.

Approaching family members for a financial loan

Credit out of family relations is a useful replacement for taking out a bridging mortgage, and you may help you save money with the charge. It’s important to be transparent exactly how a lot of time you will require money to have and exactly how you want to spend they back.

Private traders

When buying assets as a good investment, like with the build, refurbish and you can book model, you’ll be able to turn to acquire away from a loan provider, or utilize the funds of a personal individual.

Just how these alternatives contrast count on both deal you will be provided by a bridging lender and that offered by the fresh new buyer.

Always, a bridging mortgage lender are more predictable within means than just an investor rather than become involved on the opportunity details.

Personal buyers usually do not always work to lay conditions and will maybe not getting controlled, definition you could be susceptible to disturbance on endeavor, or unforeseen transform to your arrangement. If you intend to partner with individual investors it is advisable to find legal services to provide understanding to your words of your own contract.

Discussing having an existing lender

If you’ve stumble on difficulties with your financial seller and you can have arrears, you happen to be questioned to get the loan in full, otherwise face the latest threat of repossession.

A connecting loan are often used to repay the mortgage, on focus put in the borrowed funds, causing you to be without monthly repayments and make.

installment loans bad credit Oregon

This can be a temporary arrangement when you find yourself waiting to offer the property otherwise cleanup your money before you take out another mortgage.

The costs off connecting fund is greater than those people for the home financing. Even though you aren’t expenses one monthly installments, you continue to feel accumulating attention, and this have to be paid back.

Many lenders could be keen to eliminate last-resort steps and just have specialist communities to simply help those in personal debt, having a selection of alternatives. If you’re sense problems after that speak to your bank as soon as you are able to to help you explanation your position.

Fast domestic to get people

Fast house to find companies are often used to release security off a property quickly. The key differences try connecting finance gives you maintain control from the home, whereas quick home selling businesses are purchasing the advantage from you.

You will need to note that punctual orders organizations constantly render no more than 75% in your home really worth, definition they make a significant earnings to your possessions.

If you like money urgently, and do not desire to keep property to reside in or build next a simple-domestic selling will be an option albeit the one that results in your preserving a reduced amount of your own property’s well worth.

Interest, charges and you may Apr

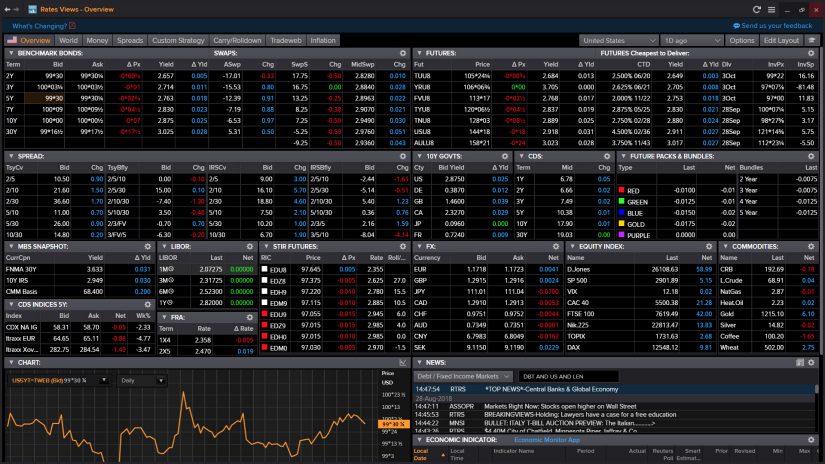

The pace charged, one charge therefore the Annual percentage rate (a measure of the general cost of borrowing) are top factors. While rates isn’t that which you, where other factors during the a comparison are comparable, a saving into costs are going to be a simple way to differentiate items.

At the same time, if you’re towards the an adjustable mortgage rate your own attract repayments can move up otherwise down. Even though the lenders tend to changes prices according to research by the Financial from England base cost it ultimately set their unique pricing and you can would not at all times must instantly reflect one transform. For folks who wanted certainty regarding your repayments factors to consider to allow the financial learn this and you can talk about fixed price products.

Month-to-month can cost you

Also full can cost you, it’s important to determine your monthly costs. Connecting mortgage charge might be put in the borrowed funds and you can paid back once you sell a property. Other types of mortgage requires monthly premiums, and in the fact off a second-charge financial you’ll have to create a couple repayments every month which may be a permanent sink on the information.