The good thing: You really have selection in the event you happen to be having a hard time qualifying toward home loan you prefer. When you look at the a housing industry which is viewed ascending home prices, next ascending rates, it’s not uncommon to want only a little significantly more loan than just you anticipated. A non-certified financial may get your more liberty today. In case your state advances, you will be able to refinance to obtain most readily useful terms and conditions afterwards.

Non-accredited mortgage loans are not due to the fact preferred because old-fashioned financing, however they are offered by way of many banking institutions, borrowing from the bank unions and you can lenders. Some types of non-accredited mortgage loans are simpler to find than others. Jumbo financing, such as for instance, are pretty prominent.

You’ll be able to start with talking-to your financial or borrowing https://paydayloanalabama.com/movico/ relationship to see if they supply financing that fits your position. Otherwise, you may want to think working with a mortgage broker exactly who helps you identify your demands and you will highly recommend options. Of numerous on line loan providers has actually low-accredited loan options as well.

If you get a low-Accredited Financial?

Non-certified mortgage loans work most effectively getting borrowers who possess enough earnings and assets to pay for home financing, however, whoever income is hard to help you file otherwise whoever highest debt load or recent credit factors make sure they are search riskier in order to loan providers than simply they really is actually. As much as possible pay the even more bucks within the costs otherwise focus, a non-accredited home loan could help you support the loan you want.

- Definitely are able to afford they. A low-certified mortgage actually of use for many who finish delivering a home loan you simply cannot pay for. If the earnings actually is unreliable or the debt weight also higher, you’ve got issue fulfilling your own month-to-month mortgage payments. Increased interest will result in higher will cost you along the lifetime of the loan. Prior to signing that loan agreement, make certain this is exactly a loan you can accept.

- Feel a skeptical buyer. Score several choice and you will evaluate. Simply take a close look during the Annual percentage rate, closing costs and you may fine print.

- Check out the options. Unsure a low-accredited home loan is a good package for you? Remember scaling off your residence buy and also make your loan economical. You can even hold off-giving your own borrowing from the bank time for you to recover, to find out if home prices otherwise rates average or even to allow time for you to save yourself more money to own a deposit (decreasing the level of home loan you will need).

The bottom line

A low-licensed home loan will help bizarre buyers score mortgage recognition. But even a non-accredited mortgage isnt instead requirements: It is possible to still need to show an ability to repay the loan and, when you signal the loan docs, you will have to generate prompt money over the long lasting. When the a low-qualified financial gets your on the a house yourself terminology, its an advantage. If it looks like this may offer your beyond your individual restrictions, you’re best off looking other choices.

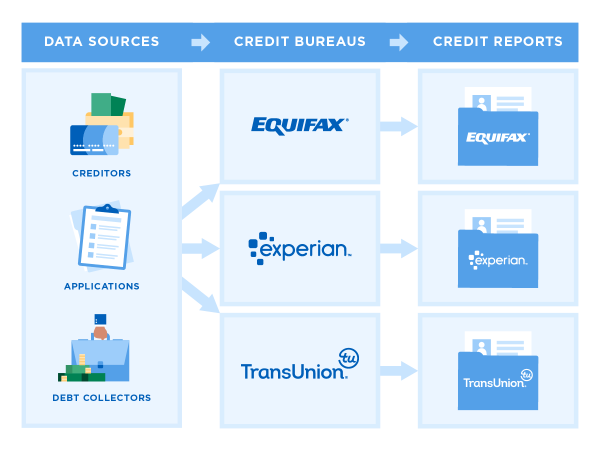

If going for a non-accredited otherwise conventional home loan, your borrowing from the bank is paramount to protecting an educated interest rates and you will terms with the a mortgage. Look at the credit file and you can credit score free of charge to see where you stand-and you can discover helpful tips with the enhancing your credit.

Curious about the home loan solutions?

Discuss individualized alternatives away from numerous loan providers and make advised conclusion in the your property financing. Leverage professional advice to find out if you can save tens and thousands of dollars.

Dana George keeps a good BA in management generally and you will Business Advancement regarding Spring Arbor College or university. For over twenty five years, she’s composed and you may claimed into the business and you may finance, and she is however excited about their functions. Dana and her husband recently gone to live in Champaign, Illinois, household of your Attacking Illini. And even though she finds out colour lime unflattering of many some body, she thinks they will certainly delight in Champaign enormously.