However the CRA supporters, like the Nyc Minutes, continue to declare that CRA-accredited money made by managed loan providers did well and you will ought not to become accused inside our most recent issues. They point out the outcome regarding an assessment off CRA fund by Northern Carolina’s Center to own Community Resource, hence discovered that such as money performed a lot more defectively than just conventional mortgages however, a lot better than subprime money complete. Whatever they cannot speak about is that the data examined merely nine,000 mortgages, a drop on the bucket compared to the $cuatro.5 trillion within the CRA-eligible loans that the professional-CRA Federal Area Reinvestment Coalition prices have been made given that passageway of your own Work. There were zero medical studies, of the either the us government Liability Work environment or perhaps the Federal Reserve, of overall performance out of finance cited from the banking companies within their CRA filings. Of several eg funds weren’t also underwritten by banks by themselves, which purchased CRA-qualified money (claimed such books because the American Banker) following resold them. How would instance a network not cause problem money and you will high delinquency and you will property foreclosure rates? Seven years ago, in the event that national mediocre delinquency speed is 1.9 %, Scratching explained the rate having their organizations’ fund is actually 8.2 %.

It looks clear that people has, while the a question of federal coverage, pushed way too many homes to the homeownership. One another governmental events is actually guilty. Democrats was basically mainly guilty of the Fannie and you may Freddie reasonable-housing requirements, but the Plant administration advertised the thought of allowing people of Point 8 leasing-construction vouchers-very poor home-explore their houses subsidy due to the fact an advance payment to the a home loan.

Into the sharp contrast to your dated regulating focus on coverage and you can soundness, government now judged finance companies not on exactly how its money did, however, about how precisely of several funds it produced also to whom

Lookin to come, just how is always to we believe on our very own economic climate because it applies to help you People in the us regarding small function? We do have the gadgets in place getting a reasonable and you can productive construction plan. Fair-housing and you will antidiscrimination laws should be implemented so that potential borrowers commonly turned into aside for nonfinancial factors. Credit scoring-which did not can be found at the time of the first passage of this new CRA-allows loan providers to tell apart certainly home out of comparable earnings however, additional levels of frugality and you will thrift. Let’s enable it to be these types of field mechanisms to perform, rather than counting on regulating mandates together with governmental chance it present toward monetary segments.

Howard Husock, a contributing editor out-of Urban area Log, ‘s the New york Institute’s vice president to have policy search, the new manager of the Public Entrepreneurship Effort, together with author of America’s Trillion-Buck Houses Mistake.

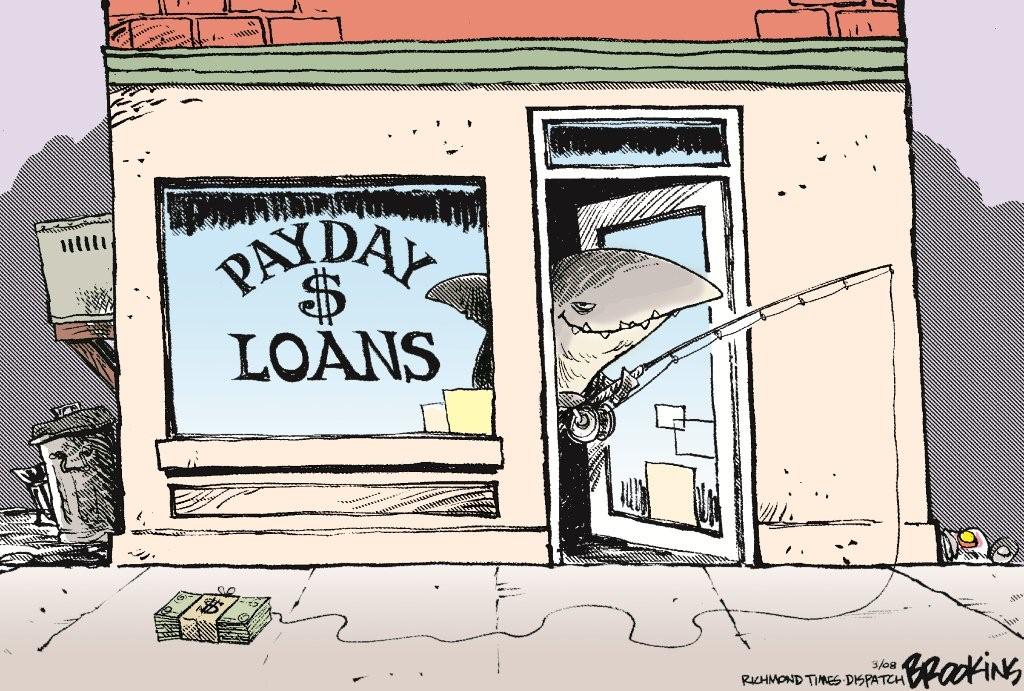

Substantial pools of money was born allocated into the an entirely this new means. In https://paydayloancolorado.net/applewood/ general former vice president out-of Chicago’s Harris Bank immediately after informed me: You just need to be sure to cannot turn someone down. In the event the anybody applies for a loan, it’s better for your requirements simply to provide them with the cash. A high assertion speed is really what becomes you in big trouble. It’s no wonder, next, one as soon as 1999, the latest Government Set-aside Board unearthed that simply 29 percent of financing into the lender lending applications dependent particularly for CRA compliance motives you certainly will become classified as the winning.

Financial examiners first started playing with federal domestic-loan research-separated of the neighborhood, earnings, and you will competition-in order to price banking companies on the CRA results, standing conventional credit with the its head

How many of your troubled Fannie/Freddie financing was indeed along with employed for CRA intentions from the finance companies that originated all of them? You can’t really discover; government haven’t over a tight investigations. Neither has CRA supporters pressed for any show recording. Even so they have been yes accused within our introduce situation. One to leader off a critical Nyc lender has just informed myself one Federal national mortgage association scooped upwards most of the CRA finance the guy began. Since economist Russell Roberts from George Mason School explains, Financial off The usa reported that nonperforming CRA-qualified loans had been a significant pull with the the third-quarter 2008 income. The money report claims: We still come across destruction within our people reinvestment work collection and that totals certain eight % of the residential publication. . . . The fresh new annualized losings speed from the CRA publication are 1.26 per cent and depicted 31 % of the home-based mortgage internet losings. This is exactly a far cry regarding the advocates’ fundamental range you to definitely CRA finance, while you are shorter financially rewarding than standard mortgages, are still winning.