To buy a first house is an option milestone in life even though scientific, dental and you can veterinary benefits can take advantage of benefits when it comes to protecting home financing, you can find downfalls to be familiar with.

Very first house is a lot more than a threshold more your own direct. The house or property is additionally a secured asset, the one that is always to take pleasure in inside well worth through the years.

In fact, of many medical professionals will hold onto its basic family and use it a residential property while they are prepared to update on the 2nd household. Thanks to this they often is useful has actually an investor therapy even when you is to find a property to live in.

However, a long time before you start planning to discover home’ inspections, it is worthy of providing around three early steps to make your property to get trip since the seamless that you could.

1. Surround yourself that have gurus

To order a primary family is cover a steep discovering contour while desire to be yes you earn they right.

Meeting a team of advantages not only streamlines the latest to shop for procedure, additionally will provide you with the advantage of elite group possibilities to end expensive problems.

The party out-of positives would be to preferably become a mortgage broker you to definitely specialises on your job including Avant Funds. The reason being a professional financing vendor can get complete degree away from ds, occupation trips and you may borrowing users, all of which is essential with regards to securing an effective home loan.

A trusted solicitor otherwise conveyancer also needs to means part of their class eg Avant Rules. Their role is to try to review an effective property’s income offer, and you will select any clauses which could performs facing you, in addition to making sure a hassle-totally free import of the house to your label.

To possess doctors, dentists and vets that happen to be date-poor or to acquire within the an unknown urban area, a professional customer’s agent will likely be an important introduction to the party.

Since an initial domestic consumer you’re eligible to a monetary permitting hand through some attempts. It is really worth knowing what’s going on having holds.

For example, The first Homeowner Offer, differs round the Australian claims and territories, and will end up being well worth between $ten,000 or more so you can $fifteen,000 step one .

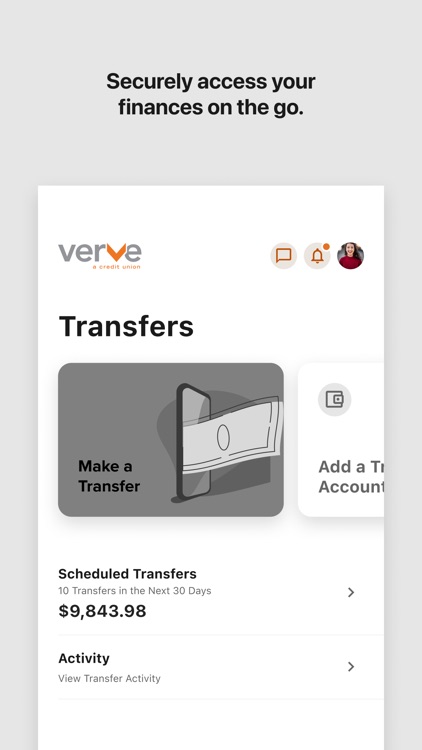

Other choices range from the Earliest House Make certain 2 which allows very first homebuyers to access the market industry having only 5% put. But not, physicians, dental practitioners and you may vets receive preferential procedures off lenders and are generally provided lower put financial alternatives too.

Conditions and you can qualification standards commonly apply at these schemes. The Avant Fund lending pro normally explain any efforts it is possible to qualify for.

3. Get the funds during the great figure

After you get a home loan, loan providers will want to come across a robust track record of rescuing, even though some finance companies will also believe normal rent repayments given that deals history’.

What’s quicker obvious is the fact a financial will appear on overall borrowing limit in your credit card instead of the the equilibrium. It being the instance, it could be sensible getting in touch with their card company to request a loss in the credit limit before you apply for a loan.

When you’re these sorts of products are to any or all first family buyers, scientific, dental and you can veterinarian advantages can be deal with even more factors.

Particularly, extremely common to own medical professionals to create a large HECS personal debt. Dily to invest down as often of its HECS balance while the you’ll just before obtaining financing.

But not, this may functions facing you. The amount owed inside HECS is normally out of reduced interest so you’re able to a loan provider compared to reality you have got a great bad credit installment loans Ohio HECS loans.