After you apply for a property equity financing, you’ll end up subject to a difficult borrowing query, that could lead to your get loans with bad credit in Daphne to drop because of the a few factors. You should observe that a house security mortgage won’t feeling the borrowing usage proportion because it’s an installment mortgage, maybe not an effective rotating credit line.

However, when you yourself have one types of borrowing on the borrowing from the bank reports, including handmade cards, a home equity loan you certainly will improve your credit merge, that may end in a moderate hit towards the credit rating. As you generate an optimistic fee background through to your-day mortgage money, you might like to visit your credit score boost.

Exactly like a house guarantee mortgage, once you make an application for an unsecured loan, you are subject to a hard borrowing query in the mortgage application process. This may negatively perception your credit score.

Once the an unsecured loan try an installment mortgage and not a good personal line of credit, it’s not going to foundation to your borrowing use ratio. Yet not, by using a personal loan to pay off almost every other large-appeal credit card debt, your own credit utilization proportion you will drop-off, which will possibly help your credit score.

If a personal bank loan improves their borrowing from the bank blend, it might bring about a little hit towards credit score also. Setting-up a positive percentage records may help your get, also.

Is actually a property equity mortgage just like a great HELOC?

A HELOC and household collateral mortgage are not the same. Whenever you are one another financing issues help you access guarantee in your home, he’s additional within design. When you find yourself a home collateral financing try a payment loan which have an excellent fixed payment, a good HELOC functions a lot more like credit cards that have good rotating credit line.

Just what are options to help you a property guarantee mortgage otherwise a personal mortgage?

- HELOC: Family equity lines of credit (HELOCs) is a variety of revolving borrowing from the bank you to lets a debtor accessibility its home’s collateral. You might withdraw and you can pay off the personal line of credit many times.

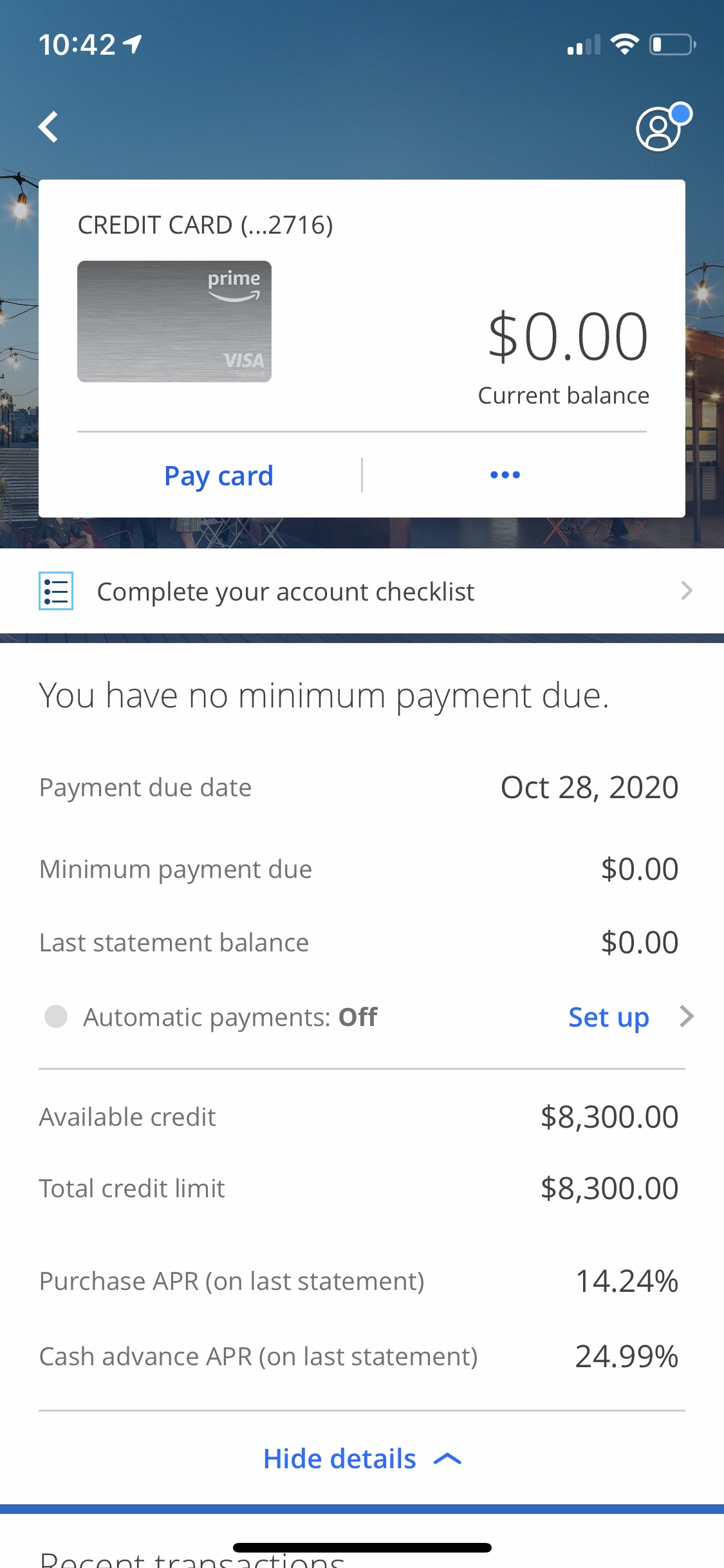

- Credit cards: Instance an excellent HELOC, credit cards was a type of rotating borrowing. However, in place of an excellent HELOC, playing cards usually are unsecured. And you may, often times, handmade cards bring an excellent 0% Annual percentage rate introductory several months, that could act as an interest-free loan for individuals who pay-off their full equilibrium till the promotional period concludes.

- Cash-aside re-finance: Cash-away refinancing lets a debtor to help you re-finance the home loan to own an enthusiastic count bigger than whatever they already owe. You are getting the extra matter as dollars, minus settlement costs.

Bottom line

Regarding getting that loan and you will hence form of suits you, i don’t have a one-size-fits-every service. When you yourself have significant collateral of your house, a property equity mortgage you can expect to render a low interest rate option to loans a venture otherwise pay for a crisis or unplanned bills.

But your household equity isn’t really the just accessible alternative once you you would like money. If not need certainly to place your household at stake and don’t need a large amount, a personal bank loan could well be what you need to suit your book individual fund problem.

Fundamentally, lenders need to make sure you might easily afford your home percentage, very they are going to and additionally focus on your debt-to-earnings (DTI) ratio just before granting you for a financial loan. DTI is actually a good metric banks use to measure what you can do to help you pay-off the loan. They stands for the latest part of the gross month-to-month earnings you use to suit your month-to-month personal debt money. In general, the DTI proportion will should be below 43% so you can qualify for a house collateral financing.

And rates, it is possible to possibly spend an enthusiastic origination commission or a management payment which have an unsecured loan, that’s generally taken from the loan amount once your loan is approved. Pose a question to your bank in case the financing has a prepayment penalty from inside the case we would like to pay back the mortgage in full up until the end of your term.