Inclusion

Around australia, restoration loans play a vital role in helping property owners fund its renovation ideas. This type of money supply the expected savings to deal with the desired developments versus pushing your own discounts or disrupting your hard earned money move. Recovery fund enables you to change your home you can try these out to your fantasy house, therefore it is hotter, useful, and aesthetically enticing.

But not, getting a restoration financing gets to be more tricky when you yourself have crappy credit. Your credit history and you will credit history gamble a critical character for the financing acceptance decisions. Lenders evaluate your creditworthiness to find the level of exposure relevant which have financing your currency. Poor credit, described as a decreased credit history, can negatively perception your odds of financing acceptance and could result into the high interest levels otherwise stricter terminology.

As the perception of bad credit on financing acceptance can seem daunting, selection are around for target these types of pressures. By the knowing the affairs loan providers consider, using strategies to alter your creditworthiness, and you may investigating choice lending products, you could increase your probability of getting a repair financing, despite less than perfect credit.

This new Perception off Bad credit into Renovation Financing Recognition

When getting a repair financing which have bad credit, this new effect of one’s credit score can’t be forgotten. Fico scores gamble a significant role regarding financing recognition techniques, because they promote lenders that have understanding of their creditworthiness and you may feature to settle the borrowed funds. In australia, fico scores typically cover anything from 0 to at least one,200, having large ratings proving all the way down borrowing from the bank exposure.

Less than perfect credit produces protecting a remodelling loan difficult for some grounds. To begin with, loan providers will get consider borrowers having the lowest credit scores since the higher-chance individuals, leading them to reluctant to offer credit. Subsequently, even if you look for a lender happy to assist you, they could enforce large interest rates or more strict terms because of the latest understood chance.

On top of that, lenders can get topic loan applications from people who have poor credit to help you increased analysis. They may want much more documents, proof of money, and you will equity in order to decrease its chance. This will improve loan application procedure longer-taking and you can difficult.

Approaches for Conquering Demands and getting a restoration Loan which have Crappy Borrowing from the bank

If you’re bad credit will get expose barriers, discover procedures you could use to overcome such demands and you may raise your odds of acquiring a remodelling loan.

Assessing and you may boosting your creditworthiness

Start by evaluating your credit reports when it comes down to discrepancies otherwise problems. Get in touch with credit bureaus to help you fix errors and make certain their credit record is truthfully depicted. This task is crucial, given that also a small change in your credit rating normally notably affect financing acceptance and interest rates.

2nd, run reducing your the bills and you can credit utilisation. Pay off higher-notice debts and you may make an effort to keep the credit utilisation lower than 30%. Lenders view individuals which responsibly carry out its expenses and you may borrowing as the much safer.

Starting a positive fee history is an additional important step in improving their creditworthiness. Make certain you build your payments punctually, and additionally rent, utilities, and you may costs. Uniform towards-go out costs demonstrated your commitment to financial responsibility and certainly will surely effect your credit rating.

Examining solution financial loans

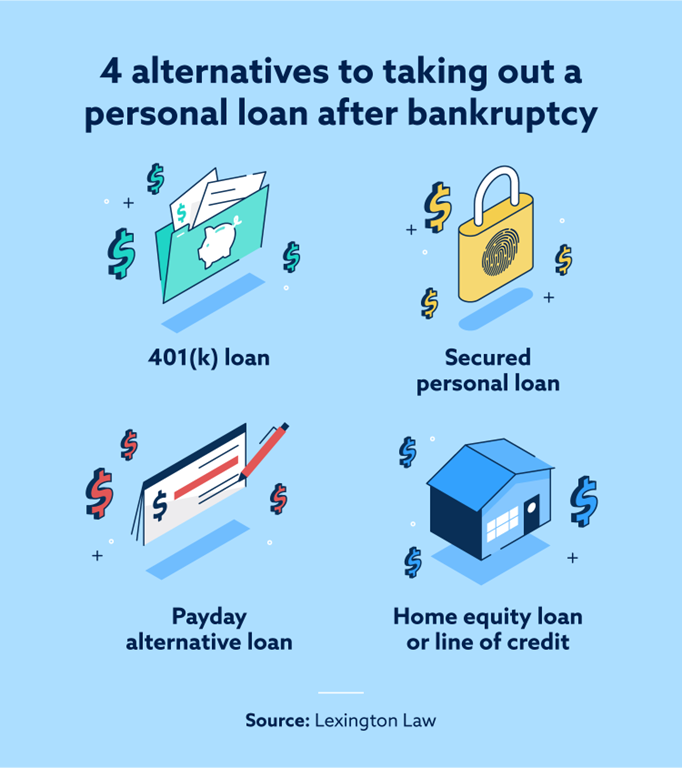

Whenever antique lenders try reluctant to provide a repair loan owed to bad credit, it is well worth exploring option financial loans.

Government-recognized res, like those given by new National Property Financing and you can Money Agency (NHFIC) in australia, provide available money options for individuals with bad credit. These types of apps normally have a whole lot more flexible qualification conditions that can render all the way down interest levels than conventional money.

Peer-to-peer credit systems try another solution worth considering. Such systems connect consumers in person that have individual loan providers prepared to money repair programs. Peer-to-peer lending are a viable choice for people who have crappy borrowing from the bank, given that specific lenders get interest on the fresh borrower’s capacity to repay as opposed to its credit score.

Secured loans, in which security exists as shelter, is also a choice for consumers that have poor credit. By providing an asset such as for instance property otherwise an auto due to the fact equity, loan providers are significantly more ready to expand borrowing from the bank, as they can recoup their resource in the event your borrower non-payments.

Trying to help from borrowing from the bank guidance agencies

Borrowing from the bank guidance businesses can provide worthwhile information and you may support for people with bad credit. Such agencies can help you make a great customised plan to increase your credit score and manage your expenses efficiently. They may discuss having creditors in your stead to ascertain fees agreements otherwise promote economic studies in order to build informed choices.

Co-signer factors in addition to their affect financing recognition

An excellent co-signer with a good credit history is also rather boost your opportunity of experiencing a renovation financing. A beneficial co-signer promises the loan and you will requires obligation getting payment if you standard. Lenders could be a whole lot more happy to approve the borrowed funds and gives top terms and conditions whenever a great creditworthy cosigner is with it. But not, its imperative to keep in mind that co-finalizing is a huge obligations, and you will both parties should very carefully take into account the prospective ramifications just before continuing.

By implementing these types of strategies, people who have poor credit is also enhance their probability of obtaining a beneficial repair mortgage and you may carry on their property update travel.