Preservation Districts and Pure Information Maintenance Services (NRCS) render cost-express applications that can help you buy fencing, integrated insect administration, and other maintenance perform.

State Preservation Districts performs directly with regards to Government equivalents new Sheer Information and Maintenance Provider but provide programs inside county in the which they are depending. Find nearby preservation work environment by going to the Pennsylvania Organization out-of Preservation Districts Inc. or by the calling all of them from the 717-238-7223. You can also find nearby Pennsylvania Conservation Section on the internet.

To possess facts about the brand new USDA Absolute Financial support Preservation Solution (NRCS) see hawaii Offices Directory. NRCS also have more right up-to-day information about pricing-display programs and you can conservation solutions for sale in your own state. Pick nearby work environment inside the PA on line.

NRCS has some programs made to conserve ground and you can include brush liquids. They offer technology guidance and cost revealing for the majority of preservation practices. You are needed to fund the latest habit following implement for reimbursement for their part of the costs.

Owing to its Preservation Innovation Grants, NRCS will bring grant financial support to have approaches or tech which have good higher opportunity for achievements. Look for much more information towards financial assistance NRCS even offers banks in Idaho that offers personal loans online on the internet.

Such: Environmentally friendly High quality Incentives System (EQIP) provides financial and you may technical assist with agricultural makers so you’re able to target pure financing inquiries and you will send environment positives particularly enhanced water and you will air quality, stored ground and you may facial skin liquids, shorter surface erosion and you may sedimentation, otherwise improved otherwise written wildlife habitat.

Finance

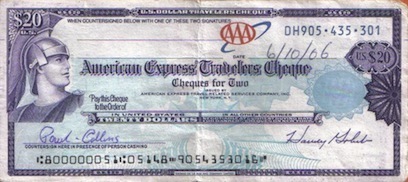

Many industrial loan providers, from higher to help you regional and you can local finance companies give currency so you can farmers. You will need to make relationship with your finance companies and provide the new documents needed to assess your ability to settle the newest loan. If you are working with a lender for the first time, it could take longer to cultivate a rapport and you can complete the loan techniques.

If you are a primary-date borrower and want to loans a farming procedure, you’re directed on the Farm Services Agency (FSA) getting let. FSA funds money so you can farming surgery when an alternate financial features rejected you to definitely procedure.

Ranch Provider Agency works several ranch loan apps and you can funds money to have land requests, functioning can cost you, and can and additionally verify funds created by almost every other lending establishments. This new financing originates from Congressional appropriations while the money is exhausted, you might have to hold back until the following bullet off appropriations.

- Get farmland

- Make and you will fix property

- Build farm developments

A specific portion of the resource try designated for ladies, African People in america, Alaskan Natives, American Indians, Hispanics, Asians, Indigenous Hawaiians, and you may Pacific Islanders.

FSA’s Doing work funds are designed to be paid down within this a beneficial several-times some time enables you to get points such as:

- Animals and you may offer

- Farm equipment

- Stamina, ranch chemicals, insurance policies, or any other doing work can cost you, in addition to friends cost of living

- Small advancements or repairs in order to structures

- Refinancing certain ranch-related bills, leaving out a residential property

FSA’s Microloans was lead farm operating financing with a shortened software processes and faster papers designed to meet the needs from shorter, non-old-fashioned, and market-particular functions. Such microloans may also be used to possess house orders.

Anyone can get and receive two small-fund at the same time

The newest FSA apprentice and mentorship programs, non-ranch providers sense, and farm work experience are acceptable option choices to have assisting to meet ranch sense and managerial requirements. Pick much more information since the microloan program on the web.

FSA will guarantee farm finance produced by other lenders. The lending company lends you the fund and you will FSA deliver a beneficial make sure that the mortgage might be paid back. They may be able guarantee 90% of loan normally or over to help you 95% from inside the unique facts. FSA costs an affordable desire commission to your be certain that. Find more details since the FSA mortgage software (PDF) on the internet.