You could believe that declaring bankruptcy proceeding will prevent you from ever before qualifying for home financing. Luckily for us, this is simply not your situation; acquiring a mortgage after bankruptcy proceeding is possible. When you yourself have filed to possess Chapter 7 otherwise Part 13 personal bankruptcy, you happen to be in a position to receive a home loan once a particular prepared months.

To decide just how your particular personal bankruptcy circumstances often apply to your ability to purchase a home, it is to your advantage to contact Cleveland Bankruptcy Attorneys within (216) 586-6600 to speak so you’re able to an experienced Ohio bankruptcy lawyer who can help you with your daily life just after case of bankruptcy.

The necessity of Reestablishing Borrowing

Because they build up your borrowing, you can easily enhance your probability of delivering approved to own a mortgage. You could start building up your own borrowing from the bank if you are paying from a beneficial protected bank card entirely monthly.

A secured bank card will function as a good debit credit but allow your craft getting stated to your three big borrowing from the bank reporting providers every month. Once you’ve collected your credit with a protected credit card, you will need to work with exhibiting obligations round the several lines of credit.

You can buy an unsecured charge card, car loan, otherwise a personal loan and have you are an accountable debtor which have varied borrowing from the bank streams. It’s important to refrain from several lines of credit in case 24 hour payday loans Our Town AL the finances does not allows you to create money completely.

Qualifying getting Mortgages Immediately after Bankruptcy

The waiting several months to have protecting an interest rate will depend on the sort of loan you’d like and type off bankruptcy proceeding having you recorded. Let me reveal a short history of the wishing episodes towards the all types of lenders available:

- Antique Loans- A traditional financing try a mortgage that’s not insured otherwise from a government entity. Conventional funds will be hardest to acquire shortly after declaring bankruptcy proceeding. If you’ve been released away from Chapter 7 bankruptcy proceeding, your own wait period might be few years. Adopting the a chapter 13 bankruptcy proceeding release, you are expected to wait 2 years. Personal lenders sometimes have more wishing symptoms.

- FHA Loans- A keen FHA home mortgage is insured because of the Government Houses Management. While you are interested in delivering home financing after bankruptcy, an enthusiastic FHA loan try an intelligent solution. To get acknowledged for starters just after a section 7 bankruptcy proceeding, your own case of bankruptcy should be discharged for a few many years before applying. Should your bankruptcy proceeding was a part thirteen, you could potentially submit an application for an enthusiastic FHA mortgage whether or not it are released a year ahead of.

- Va Funds- Va loans was backed by Agency off Seasoned Affairs and you may only available so you can veterans that supported no less than 181 days of provider throughout peacetime, 90 days off services throughout war time, or six many years of provider throughout the National Protect. So you can be eligible for an effective Virtual assistant mortgage, the bankruptcy proceeding situation need to be ignored for two years before you can use. For individuals who submitted to own Part thirteen personal bankruptcy, you simply will not have to waiting and will apply for a great Virtual assistant loan when your case of bankruptcy has been released.

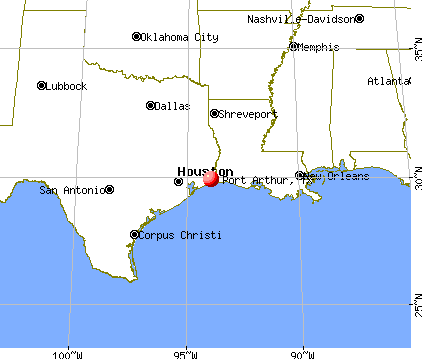

- USDA Loans- Should your property you would want to buy is within a rural town, you’re eligible for financing on the Us Service off Farming or USDA. After 36 months regarding getting a discharge getting a chapter eight case of bankruptcy, you could receive an excellent USDA financing. To possess good USDA loan once a chapter thirteen bankruptcy proceeding launch, attempt to wait per year. The newest court may also agree a USDA financing while in the a section 13 bankruptcy proceeding.