When you’re underemployed, you’re capable of getting home financing forbearance, loan modification, otherwise short-term financial help in order to wave you more.

If you cannot build your mortgage repayments, their lender may ultimately initiate the latest foreclosure process. As the property foreclosure just setting dropping your residence and significantly affects their credit, it is critical to act rapidly and you will proactively to understand more about possibilities one helps you handle your mortgage payments.

Dependent on your needs and your location, you might be capable of getting help due to a federal government otherwise lender system one to:

- gives you a rest from while making costs unless you return on your own legs

- modifies the loan to reduce your own monthly home loan repayments forever, otherwise

- brings temporary financial assistance to blow delinquent or upcoming mortgage repayments.

Does Dropping Your task Connect with The Mortgage?

Dropping your job does not change your home loan or your responsibility to create payments with the financing. The initial loan agreement, such as the interest rate, commission schedule, and you can mortgage label, remains the exact same irrespective of your work condition.

Although not, losing your work helps make handling your own mortgage payments hard. As opposed to a stable money, you could potentially fall behind when you look at the payments. Very, it is important to keep in touch with your loan servicer whenever you’ll be able to. Of numerous loan providers and you can traders give guidelines programs, particularly forbearance otherwise loan adjustment, which can promote relief by removing otherwise suspending money when you return on the legs. Or you could qualify for a national program giving home loan relief so you can people. Promptly investigating these types of options makes it possible to prevent defaulting on the mortgage and you will a foreclosures.

Remember, shedding your task doesn’t immediately indicate losing your home. you should quickly take action to address the difficulty and you may talk about all of the you’ll be able to home loan recovery alternatives that can help you if you are you are unemployed.

Apps That provides You some slack Regarding And make Costs

If a temporary adversity, like a position loss, makes you fall behind on your home loan repayments, a forbearance contract could help.

How do Forbearance Preparations Functions?

With a “forbearance arrangement,” the home loan servicer believes to attenuate or suspend the monthly home loan repayments to have a flat amount of time. At the conclusion of the forbearance, you generally must resume a complete percentage and get newest into the brand new skipped payments, and additionally dominating, desire, taxes, and you will insurance coverage. You can usually do this because of the:

- paying the financial a lump sum payment

- expenses a portion of the overdue number with your regular homeloan payment throughout the years

- deferring installment up until the loan concludes, or

- completing a modification where the financial adds the total amount you are obligated to pay with the loan harmony.

Possibly, the fresh new servicer can be increase this new forbearance in the event your hardship is not resolved by the end of your own forbearance period. You will never be susceptible to property foreclosure through the a great forbearance months.

FHA Unique Forbearance for Unemployed Homeowners

For those who have financing insured from the Federal Casing Management (FHA) and you may remove your task, you might be eligible for an effective “unique forbearance” (SFB). This option is designed to give people a way to stand in their home up until it land a different sort of business and you can resume to make their typical mortgage repayments. The applying is actually due to expire in the , however, FHA longer it indefinitely.

An enthusiastic SFB you will last 1 year https://paydayloancolorado.net/salida/, but there isn’t a maximum name limitation. And, it will be accompanied by a payment plan according to your capacity to shell out or some other alternative that can beat the newest standard.

Applications One to Personalize The loan to reduce Their Monthly payment

A beneficial “loan modification” was a lengthy-name change to your financing terms and conditions, instance an appeal-rate avoidance, which then lowers the newest payment to make the mortgage a lot more sensible.

Locate a modification, you will have to manage to demonstrate that your children possess a steady stream of income and you may make money significantly less than an altered loan. That it requirements will be difficult to meet if you’re out of work. But if you keeps an applied lover or any other breadwinners life style in the home, you could meet the requirements.

Fannie mae/Freddie Mac computer Flex Amendment

When the Federal national mortgage association or Freddie Mac possesses your loan, you could potentially qualify for the new Flex Modification system, that will all the way down an eligible borrower’s mortgage repayment by the up to 20%. You will have to reveal that family keeps a stable money stream and will make payments below a modified loan.

Variations getting FHA-Insured and Virtual assistant-Protected Funds

The federal government, such as the FHA and you will Pros Government (VA), bring special types of changes for borrowers with FHA-insured and you can Va-guaranteed financing.

In-House Modifications

Of numerous lenders have their own during the-domestic (“proprietary”) financial modification apps. Once again, you will have to show that your family members have a steady stream of income and will build payments less than an altered financing.

Help from a resident Direction Loans Program

For people who eliminate your job due to COVID-19, you are eligible to found mortgage repayment help from your nation’s Homeowner Guidelines Loans system. Towards the erican Save Package Act with the law. Part of so it legislation composed an excellent “Citizen Recommendations Funds” to add $ten billion with the says to help battling homeowners.

Apps range from state to state however, basically promote assistance with using overdue mortgage payments and you will, sometimes, coming mortgage payments and you can layer other houses-associated will set you back, instance possessions taxation and you may utilities. In certain says , assistance is organized since the an effective nonrecourse give you don’t need to pay-off. In other people, the support is within the type of a loan, that’s often forgivable.

Most Citizen Guidance Fund applications is arranged to keep up until 2025 or 2026 otherwise whenever all designated fund features go out. While many applications used all of their money and you may averted taking programs, particularly in states with high foreclosure costs, particular Resident Guidelines Loans apps will still be unlock.

Almost every other Regulators Applications Providing Financial Rescue

Certain claims has applications to simply help consumers who’re having difficulty purchasing their mortgages. Including, Pennsylvania supplies the Homeowners’ Crisis Home loan Advice System. This method facilitate homeowners in the Pennsylvania who, using no-fault of one’s own, is economically unable to make their mortgage repayments plus issues off dropping their homes in order to property foreclosure.

Speak to your nation’s houses department (possibly entitled a “casing expert”) t o see if assistance is offered your geographical area.

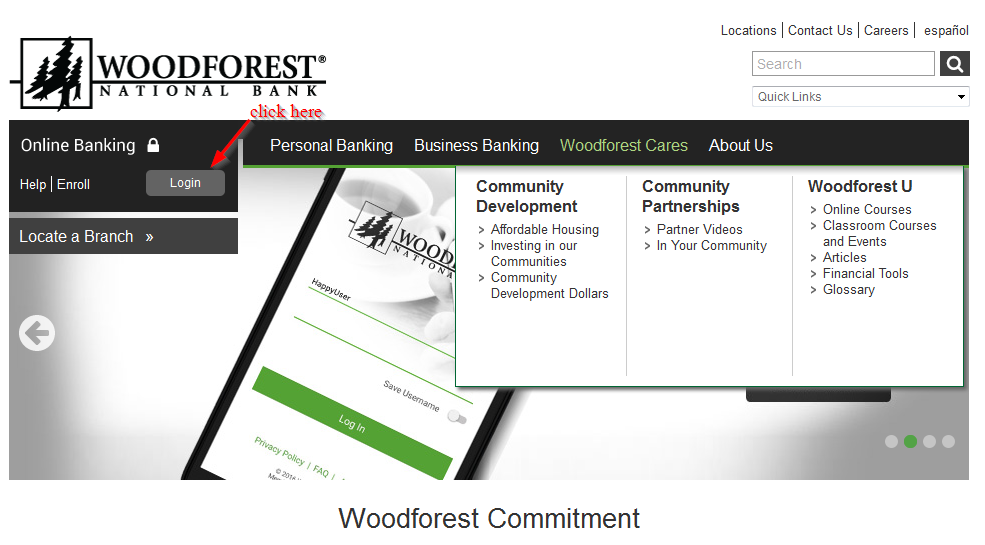

Delivering Let

If you want additional information on any of the apps stated in this post otherwise possess standard questions about getting help with your own mortgage, envision speaking with a lawyer. It’s also possible to get in touch with new You.S. Agency of Houses and you may Urban Creativity (HUD) and you can strategy to speak with a houses counselor.

An attorney or construction counselor can help you navigate the options, focus on the loan servicer, and develop a decide to take control of your home loan repayments while you are out of work. Skills their rights and you may taking advantage of the readily available info normally make a change during the whether you’ll be able to continue your home.