Are you dreaming out-of home ownership inside Michigan however, worried regarding appointment brand new strict conditions from antique mortgage loans? FHA (Government Homes Government) apps inside the Michigan could be the perfect services for your requirements. Such mortgage brokers are created to generate homeownership far more accessible, specifically for earliest-go out customers and people that have faster-than-primary borrowing. Such fund are backed by government entities, and therefore lenders be a little more ready to promote positive terminology, such as for instance lower down repayments and versatile credit rating conditions.

FHA Criteria to have Home buyers

Whether you’re selecting a comfortable residential district home or a downtown attic, FHA programs in Michigan helps you reach finally your homeownership desires. This type of loans offer aggressive rates, which makes them a nice-looking choice for of many homeowners. Happy to see if you can take advantage of the professionals an FHA Mortgage provides? Be sure to fulfill these certificates:

- step three.5% minimal down payment in addition to settlement costs and you may prepaid charges

- Lowest 580 credit history

- DTI no higher than fifty%

- Evidence of regular work and you may money

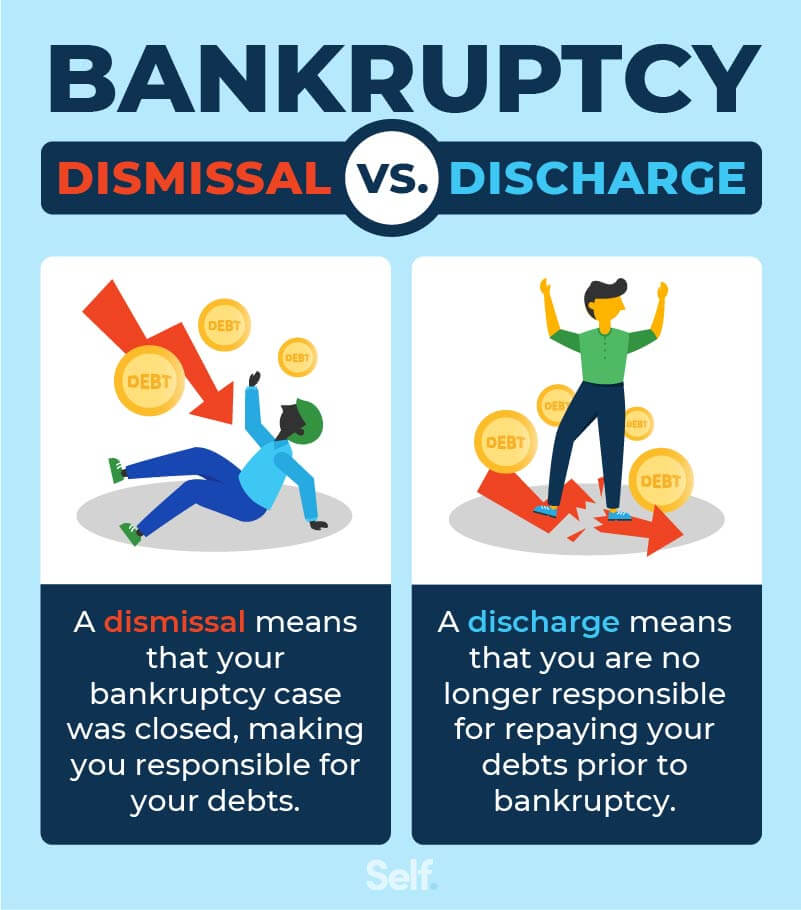

- Zero bankruptcies within 24 months

- Funded possessions must not be below 50% residential

- House should be the purchaser’s number 1 residence

For those who have any queries otherwise simply satisfy any of these, tell us. We may manage to find a far greater selection for you!

FHA Mortgage Limitations inside Michigan

2024 FHA Mortgage limits to have Kent State, Ottawa Condition, Grand Navigate County, Kalamazoo State, Ingham Condition, Wayne Condition, and you may Ionia Condition is:

- 1 Tool: $498,257

- dos Equipment: $637,950

FHA Financing Money Limitations Among the many appealing areas of FHA Fund is they lack strict income limits, unlike some other form of money. Consequently individuals need not meet a specific income endurance to help you qualify for an FHA Financing. Rather, the main focus is found on the borrower’s capacity to make month-to-month mortgage repayments. So it independence produces FHA Loans an appealing selection for a wide set of consumers, including individuals with varying income accounts and people who will most likely not be eligible for Conventional Finance limited by money limitations.

Version of FHA Government Loans

Knowing the various types of FHA authorities finance is important to have people offered homeownership courtesy FHA resource. FHA lenders bring a selection of alternatives tailored to various need and you can affairs, for every the help of its individual have and pros.

203(b) The high quality Michigan FHA Financing familiar with fund the acquisition from a house ‘s the 203(b) Financing. So it FHA mortgage is particularly popular certainly one of earliest-time homeowners and those which have negative borrowing thanks to their reduced down-payment requisite and flexible credit history direction.

That have good 203(b) Loan, borrowers normally financing up to 96.5% of purchase price of the property, definition a down payment of just 3.5% is needed. In addition, FHA 203(b) Funds bring competitive rates of interest and will be employed to pick a number of assets items, together with unmarried-loved ones belongings, multi-product services, and condos.

203k Brand new FHA 203(k) Loan, popularly known as a great treatment mortgage, permits homebuyers to shop for property and you will money the expense of ree mortgage. This option is great for consumers in search of purchasing a beneficial fixer-higher or an older domestic searching for tall improvements.

Into the 203(k) Financing, buyers range from the price and you will restoration will set you back, simplifying the financing techniques, condensing everything toward one clean mortgage. The loan count will be based upon brand new property’s asked worthy of immediately following contractor-done home improvements, ensuring enough finance to fund each other factors. This method also provides one or two versions: the standard 203(k) to own comprehensive renovations, also architectural repairs, together with minimal 203(k) to own quicker plans for example cosmetic makeup products enhancements.

HUD residential property are characteristics which were very first purchased having an FHA Loan but have since already been foreclosed. Such land are following offered of the U.S. Department regarding Housing and you will Metropolitan Invention (HUD) at great deals to recover the latest loss from the property foreclosure. HUD home will be a good chance of homeowners wanting reasonable construction alternatives, since they are will priced below market price.

Be aware that to find a keen HUD domestic inside the Michigan comes to another process. Such property are generally offered by way of an online putting in a bid techniques, addressed by the HUD-recognized Michigan Real estate agents. People normally check the house just before placing a quote and must complete its has the benefit of as a result of a great HUD-accepted broker.

HUD home can be bought while the-is actually, thus consumers have the effect of one solutions or improvements requisite. Yet not, consumers will get funds the acquisition and you may one requisite repairs with the FHA 203(k) Mortgage.

During the Treadstone, we give anywhere in mich! Apply at us and we’ll make it easier to complete down if a keen FHA Mortgage suits you, whenever it is, we shall take you step-by-step through the process! Or even, we are going to manage a plan to disperse you into the homeownership.

Frequently asked questions

Sure, FHA Finance generally need a down payment. Minimal downpayment to possess an enthusiastic FHA Financing is step 3.5% of your own price.

FHA Loans generally wanted inspections. One of the key monitors needed for an enthusiastic FHA Loan was the brand new appraisal, that’s used because of the an enthusiastic FHA-approved appraiser. The goal of the new appraisal is to try to influence the fresh reasonable business property value the home and ensure they matches minimal property criteria put from the FHA.

And the appraisal, brand new FHA may need most other monitors, particularly a home examination, to determine people conditions that can affect the security or habitability of the house. These types of inspections help protect both the borrower while the financial of the making sure the house is actually good shape and you will match FHA conditions.

Not all loan providers promote FHA Finance, therefore you will have to find one that really does. Searching to own FHA-accepted loan providers into the HUD webpages and you can, of course, you’ll want to browse the qualifications conditions ahead of you earn been.

Terminology and you will certification try susceptible to underwriting recognition and certainly will transform without notice. Not all consumers ples is for illustrative intentions.