Navigating the borrowed funds loan processes towards second day should be one another pleasing and you may difficult. Whether you’re updating, downsizing, or moving in, understanding the measures in it is extremely important getting a delicate and successful sense. This guide will bring an intensive step-by-step evaluation, out of pre-acceptance so you’re able to closure, with wisdom and you may ideas to help you hold the greatest home loan conditions and prevent popular downfalls. On best preparation and you may training, you could with certainty browse the reasons of experiencing a mortgage and move ahead for the next house with simplicity.

The latest pre-recognition techniques: starting their travel

The consumer Financing Safety Bureau (2024) claims, Good preapproval page try an announcement off a lender which they was tentatively happy to provide currency for your requirements, up to a specific amount borrowed. Bringing pre-recognized is a vital initial step throughout the real estate loan recognition procedure. Pre-recognition gives you an advantage by the signaling so you’re able to suppliers which you is actually an experienced visitors which have severe purpose. Here is how to begin with:

- File gathering: Attain most of the necessary data, together with latest spend stubs, W-2s and 1099s, tax returns and you will bank comments. It paperwork will assist you discover your financial records and you can borrowing capacity. According to the regulation requirements, it is vital to keep in mind that pre-approval for a loan does not require the new submission out of records at this first phase.

- Application: Complete a great pre-acceptance app. This can normally be achieved on the internet or perhaps in people on an excellent financial institution.

- Lender review: We will feedback debt files and you will pointers. Simultaneously, we run a credit check to evaluate your own creditworthiness, that’s extremely important inside the determining new regards to your loan.

- Pre-acceptance page: Up on winning pre-approval, you’re getting a page discussing the information of one’s prospective loan count, together with rates of interest and you can monthly payments.

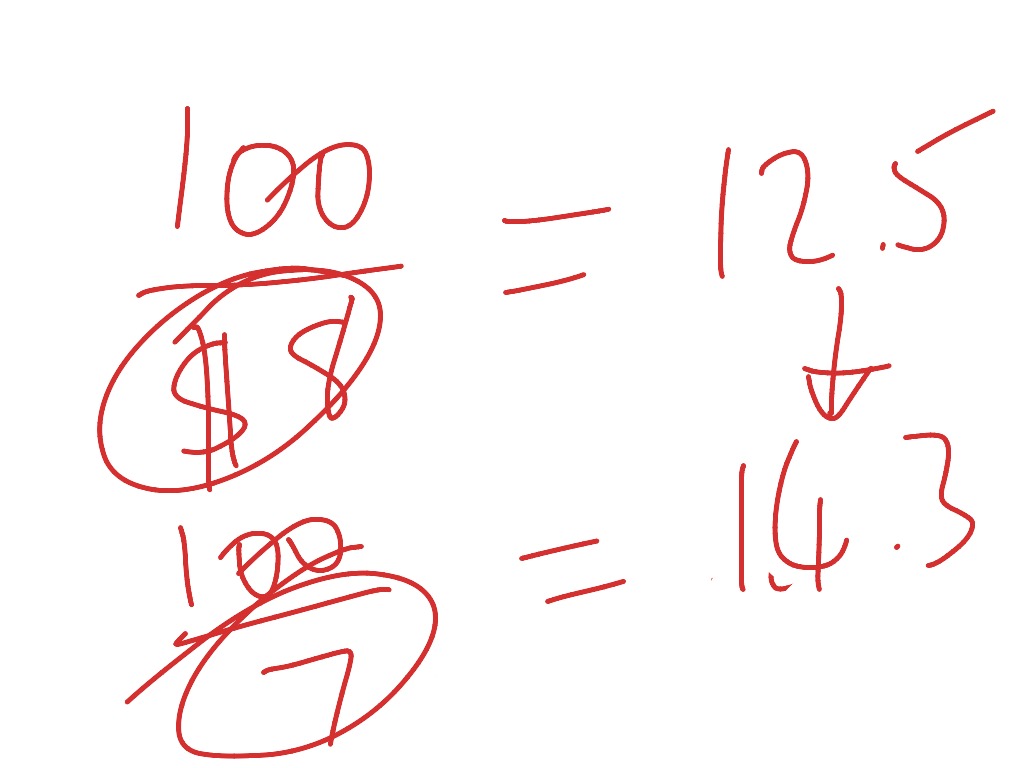

After the home loan pre-recognition process, you need to use a mortgage loan calculator to imagine their monthly mortgage payment. They works out your own monthly payment from the bookkeeping to own dominant and you can interest parts across the chosen loan term.

Becoming pre-acknowledged not only boosts the loan financing procedure and also will give you a better finances construction whenever household google search. not, it is very important remember that a pre-recognition are nonbinding.

Knowing the home loan financial techniques

Each family-to purchase feel can vary, specifically that have alterations in the market or individual monetary points. This is exactly why its smart to help you get to know for every trick phase of one’s financial process, ensuring youre better-prepared for your next purchase.

Loan application

After you have discover your brand-new household and also have your own pre-approval available, the next phase is to accomplish a formal loan application. The application form stage is the place their travel to protecting yet another home loan initiate. It requires an intensive files and you can research collection procedure that lays the latest groundwork for your financing recognition.

- Software entry: With this phase, you are able to done and you can fill out a mortgage form you to catches all of the your financial details and also the information on the house you are curious into the.

- Documents necessary: Prepare add detailed financial comments, proof earnings files such spend stubs, W-2s otherwise 1099s, tax returns, provide letters and an extensive report about the money you owe and you will property.

Loan running

Once you have registered the job, it can go into the processing stage. This a portion of the processes involves the adopting the:

- Confirmation of data: Your financial and employment information was verified to have precision. This consists of reviewing your credit score and loans membership.

- Assets assessment: Ent Borrowing Commitment usually program property appraisal to confirm brand new home’s ount is appropriate.

Home loan underwriting

Your loan software and all relevant records glance at the underwriting procedure, when your financial info is reviewed and you may verified. The latest underwriter ratings debt background resistant to the loan criteria in order to dictate the possibilities of quick repayments and you may full financing chance.

Mortgage acceptance

If everything checks out, the loan was officially recognized. Which phase finalizes new terms of the loan and you can www.cashadvancecompass.com/loans/personal-loans-for-home-improvement/ movements your towards the closure.

Tips for a smooth mortgage acceptance

Protecting a mortgage loan concerns more than just completing applications-it’s about planning your finances to present the best situation so you’re able to loan providers. Listed below are some standard suggestions to be sure that home loan app proceeds smoothly:

- Keep credit history: Ensure your credit score is within good shape. Prevent taking on the fresh debts or and also make highest requests just before and you will inside software processes.

Finally measures: closing on your own house

Brand new closure phase is the culmination of the house mortgage process. On closure, possible sign all of the required papers, pay closing costs, and take ownership of one’s new house. Some tips about what we provide:

Insights these degrees makes you navigate the mortgage mortgage acceptance procedure with ease. Following methods above and you can making preparations their paperwork beforehand ensures a great effective and be concerned-free closure on your own brand new home.

Which are the 1st measures to locate pre-accepted to possess a home loan?

Gather requisite data files such as pay stubs, taxation statements and you will financial comments. After that, complete the pre-acceptance software sometimes on the internet otherwise within a department. A financial comment credit score assessment will in addition be conducted with this phase.

Just how long do the loan loan acceptance processes always get?

The loan financing recognition process usually takes regarding the 30 so you’re able to 45 weeks from the time a software is published to its recognition. Yet not, the newest schedule can vary according to variables for example loan particular, difficulty of profit and you can underwriting minutes.