A few years ago i purchased a house on going farmlands from Pennsylvania. Shortly after specific initial research, I thought this new USDA mortgage that is certain for selecting outlying house specifically for agriculture was going to end up being most useful. However, after i already been comparing all the finance, I discovered simply a neighbor hood credit union’s conventional mortgage would save myself more funds over the long term.

Definitely, folks is going to has a separate situation. not, before you decide what type of mortgage is perfect for your needs, excite be sure to ask around while having all the information towards costs, interest rates, an such like. before making a decision.

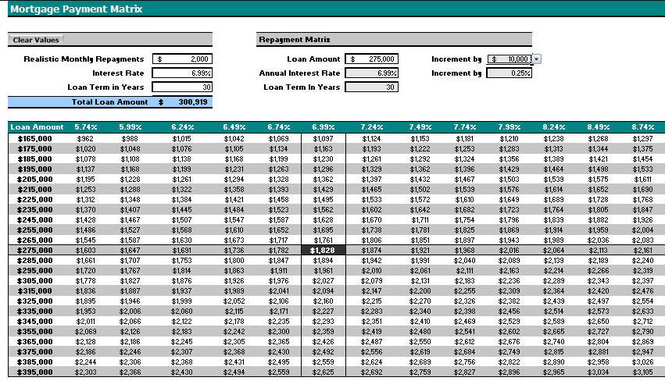

Less than there are some of my look to the kinds of from mortgages if in case they might come into play.

USDA Fund

The usa Company of Farming (USDA) in addition to Ranch Solution Institution (FSA) promote loans to possess facilities and you may homesteads. An excellent USDA/FSA mortgage to purchase a ranch is known as Ranch Ownership – Head. There are even USDA/FSA guaranteed finance, which happen to be covered.

USDA/FSA funds need either no or the lowest downpayment. They are intended for lower- to help you moderate-earnings some body, thus an element of the application will require you never surpass the income restriction.

Currently, the rate to own a beneficial USDA/FSA farm ownership financing try 3.875 percent. Bear in mind, regardless of if, one to interest levels may differ day-after-day and based their credit score. The interest rate isnt firm if you don’t receive the home loan loan out of your financial, plus the rates can go up or off regarding latest price. A high interest form you may be purchasing a great deal more within the desire. A diminished one to mode you’re expenses smaller into the appeal.

The USDA financing plus means a charge which is put into the loan count. Additionally, you will have to pay mortgage insurance coverage if you fail to spend 20 percent of the ranch initial.

FHA Loans

The us Government Housing Management (FHA) has finance readily available for first-day homebuyers. Brand new FHA does not alone generate financing, however, pledges financing that are made as a result of typical loan providers such as for instance finance companies. Playing lenders monitor cues and other recommendations indicating it take part in FHA funds.

FHA financing wanted a reduced amount of a down payment than just so antique mortgage loans to possess a property. FHA loans, with respect to the bank, are 5 % or smaller.

Even if that will be great initial, along the long-term you can spend more because the rates of interest is more than conventional money and you will has actually mortgage insurance policies, that is a supplementary $100+ a month tacked on your bill towards life of the new financing.

Conventional Fund

It’s a common misunderstanding one to traditional financing are only for those who will spend a 20% down-payment. False. We really only reduced 10 % and we also might have gone done to 5 percent actually! Recall, simply how much down-payment you really can afford will establish their appeal rate to the mortgage. Therefore a beneficial 5 percent advance payment can come that have a good cuatro.twenty-four % rate of interest however with a 10 % down payment you could safer a great step three.75 % interest.

When payday loan Highland Lake you do spend below 20 percent down-payment, you are going to need to shell out individual home loan insurance, however, instead of USDA and you may FHA the loan insurance policy is not for the life span of financing. It is simply if you don’t will get 20% equity on your own land.

Funds and you may Features

After you very own a ranch, products and other property are very important and are generally often extremely expensive. The latest USDA has the benefit of enough quicker fund having houses and gizmos.