Katrina Avila Munichiello is a skilled publisher, writer, fact-examiner, and you will proofreader with over fourteen years of feel coping with print an internet-based publications.

Picking out the perfect household for your requirements was a dream become a reality, however would-be in for a rude waking when you’re not willing to pounce when you notice it. Before going searching for you to house, you should do some work in progress as in a position in order to protected the offer.

Precisely what does which means that? It means protecting upwards an acceptable down-payment, determining ideal lending company, checking your credit rating, minimizing the money you owe, putting away dollars to have closing costs, and obtaining pre-recognition to possess home financing beforehand.

Secret Takeaways

- Make sure you has an online payday loan California adequate down payment; 20% of your price are important.

- Do your research ahead to focus on a knowledgeable bank to own you.

- Check your credit rating and you can increase they if required to find an educated home loan rates.

- Make sense your overall outstanding loans and you will skinny that one can.

- Hide away dos% to 5% of structured purchase price to cover settlement costs.

- Rating pre-recognition from your own picked lender.

Nearly 32% paid bucks to have a home when you look at the 2022, according to the home web site Redfin. That’s a considerable boost of merely 2 years before, on top of your pandemic, if this involved 20%.

Which is nice in their mind. A practically all-dollars consumer provides an edge more someone else in the event the you’ll find numerous activities in search of your house.

But not, two-thirds of your own homebuying field does not have any that sort of bucks. These customers may be homeowners in their 20s, just starting in the positioning business, and other basic-go out homeowners. Their requirement for advance preparing becomes increasingly immediate.

The latest six procedures below will help equal the playing field having your. Particularly the past action: Rating a mortgage pre-approval beforehand. It isn’t a binding file, nevertheless notification the seller that a loan provider features assessed their monetary circumstances that is able and you will ready to offer your a beneficial financial to a certain peak.

6 Packages to check on

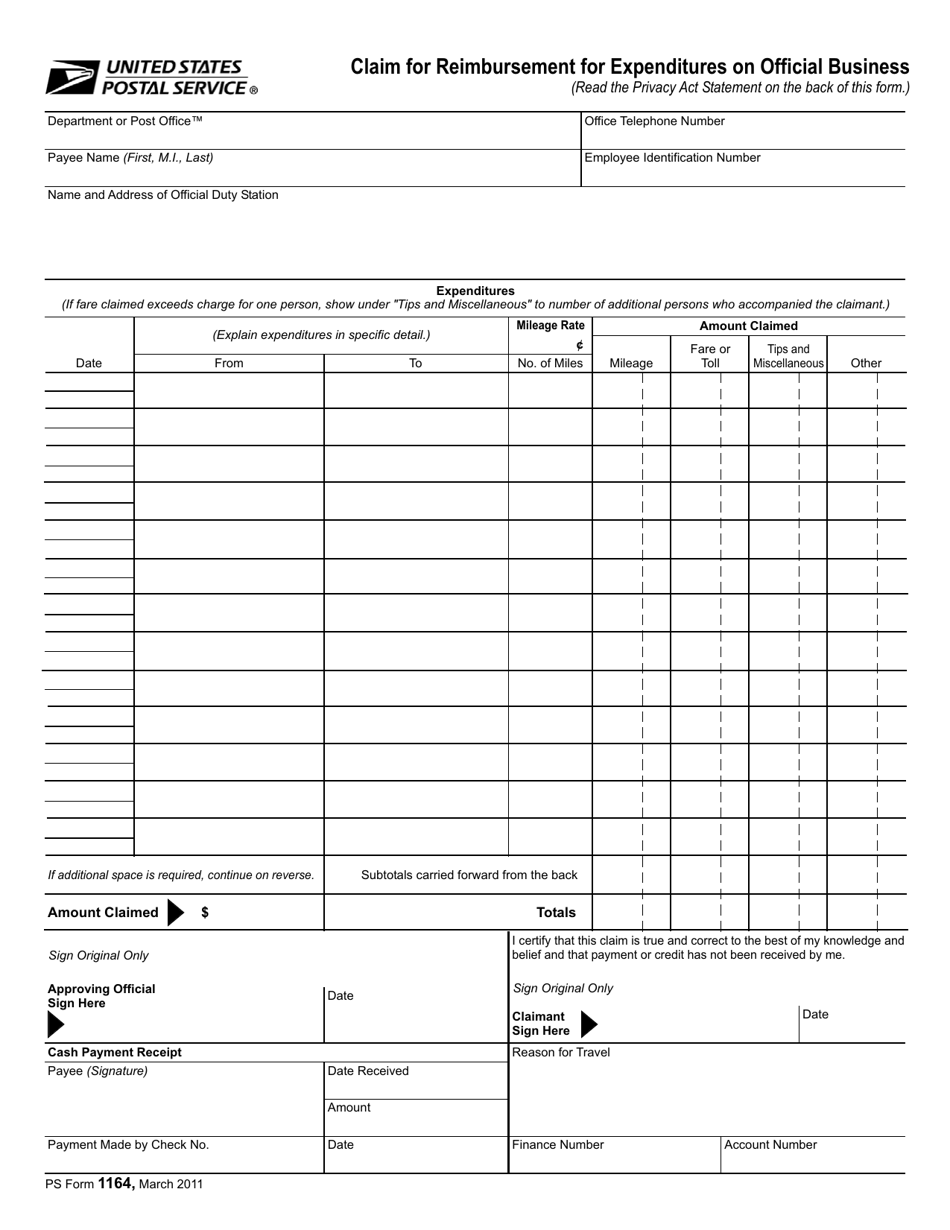

The process may vary among loan providers in most of the case, there are half a dozen packages to evaluate away from whenever obtaining a beneficial mortgage: Ensure you get your down-payment together; select a lender, look at your credit rating, look at the obligations-to-earnings proportion, reserved settlement costs, and apply for pre-approval of a mortgage.

You might add an effective real estate professional compared to that list. Eighty-nine per cent of people who bought a house inside 2023 said it discovered a real estate agent become helpful in the newest techniques.

Essential

When deciding on an agent, check out the person’s records, background, and you can experience. Inquiring family and friends to possess referrals makes it possible to discover best elite group to partner with.

Specifications #1: Collect the brand new Advance payment

The original criteria to find a house try a down payment. This is actually the currency you only pay initial to counterbalance the count you should obtain.

Loan providers keeps fasten the prerequisites given that financial crisis inside 2008, claims Karen Roentgen. Jenkins, chairman and you can President out-of KRJ Consulting. This means that, potential consumers trying to purchase a house need to have specific epidermis regarding game’ so you can be eligible for a house.

For top price available, you should have 20% to place down. Which also makes it possible to forget private mortgage insurance coverage, and that increases their monthly will set you back subsequently.

If you don’t have that sort of money, think examining your qualification having a national Homes Administration (FHA) loan. Brand new institution need only a great step 3.5% down-payment. With FHA approval, you can buy that loan off a lender on the federal agency acting as the home loan insurance company.